- More than 63 million Chainlink $LINK tokens withdrawn from exchanges recently.

- LINK price remains stable at $16, showing positive momentum in the market.

- Chainlink’s tokenization of real-world assets continues to drive long-term growth.

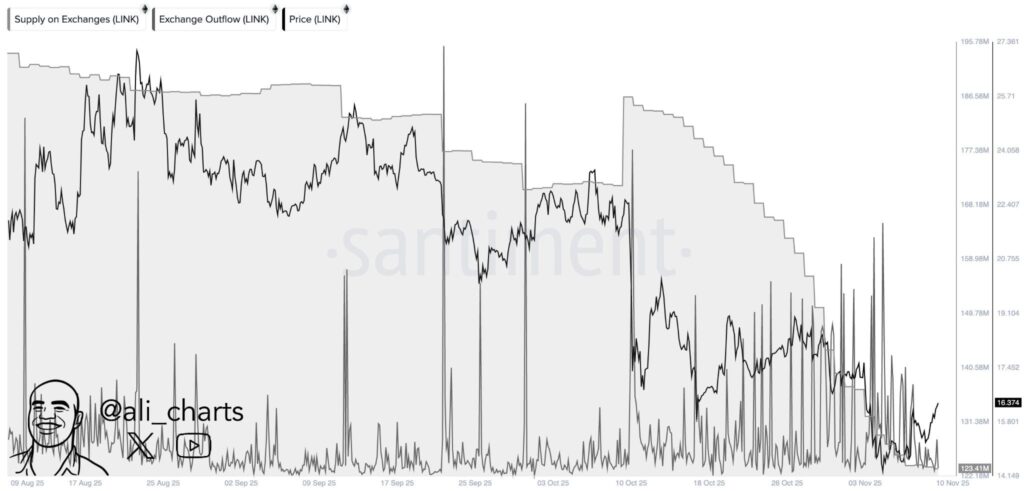

In the past month, more than 63 million Chainlink ($LINK) tokens were withdrawn from exchanges, signaling growing confidence in the network. As of today, the price of LINK stands at approximately $16.09, with the cryptocurrency showing signs of stability above this level.

This trend comes amid a broader market interest in Chainlink’s development, as the network expands its use beyond decentralized finance (DeFi) into broader tokenization of real-world assets.

Increased Chainlink Withdrawals

The most recent data reveals a sharp increase in the number of LINK tokens being taken off exchanges. Over the past month, more than 63 million tokens have been withdrawn, highlighting growing interest and accumulation of LINK by long-term holders.

According to Ali Martinez, a well-known crypto analyst, these withdrawals reflect a shift in sentiment towards Chainlink, as market participants increasingly move their assets off exchanges into private wallets.

As LINK continues to maintain its price stability around the $16 mark, many investors are hoping for a breakout that could push the price higher. However, experts note that the coin must hold above this price level to confirm its upward potential.

Chainlink’s Positioning for Future Growth

Chainlink’s increasing role in the tokenization of financial products plays a crucial part in its future outlook. The Chainlink network has continually evolved from its early days in DeFi to now enabling transparent and secure data flows for tokenized stocks, ETFs, and other real-world assets.

As more industries and sectors explore the benefits of blockchain-based tokenization, Chainlink is well-positioned to capture growing demand for decentralized oracle services. Analysts predict that Chainlink’s infrastructure could become even more integral in the coming years.

With its focus on providing reliable data feeds, the network could be key in the transition to more transparent financial systems. If this momentum continues, Chainlink’s price could experience significant growth, especially as tokenization adoption scales up in 2025.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.