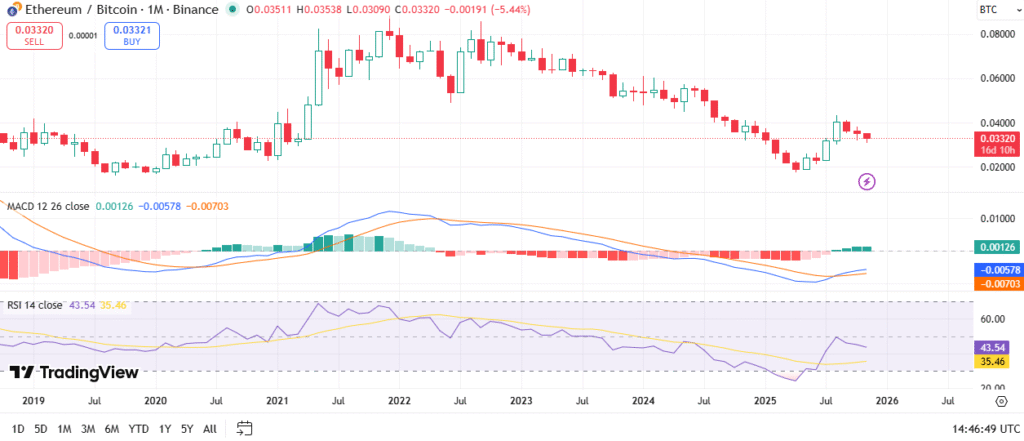

- ETH/BTC continues to slide toward a major support level near 0.03 BTC, a zone that previously halted large declines in multiple market cycles.

- The MACD and RSI show early signs of stabilizing, yet both remain below key thresholds, reinforcing Ethereum’s weak momentum against Bitcoin.

- ETH/BTC remains locked in a long-term bearish structure, with repeated resistance near 0.045–0.05 BTC limiting every recovery attempt.

ETH/BTC continues its downward trend, approaching a critical support level. The pair has been under pressure since mid-2023, unable to break above key resistance zones. Despite short-term rebounds, the overall trend remains bearish as Ethereum struggles to gain momentum against Bitcoin.

Ethereum’s Struggles Against Bitcoin

ETH/BTC has formed a series of lower highs and lower lows, highlighting Ethereum’s underperformance relative to Bitcoin. The chart shows that each attempt to recover has met selling pressure, further reinforcing the bearish outlook. The support zone near 0.03 BTC is now in focus, with Ethereum potentially testing this level in the coming weeks.

Technical indicators also paint a challenging picture for ETH/BTC. The MACD, though showing slight upward movement, remains in an oversold position, signaling weak momentum. The RSI, currently in the mid-40s, suggests that Ethereum continues to lag behind Bitcoin in terms of relative strength. Ethereum’s price has struggled to break above resistance levels, preventing it from sustaining any meaningful rally.

Ethereum Faces a Critical Test

ETH/BTC is approaching a key horizontal support zone that could provide a temporary floor for the pair. This level has previously halted declines during past market corrections, leading to potential buying interest if it holds. However, if ETH/BTC breaks through this support, further declines may follow, and a more significant downtrend could be underway.

Source: TradingView

The trader sentiment surrounding ETH/BTC suggests that a dip remains the most likely scenario. Ethereum’s performance against Bitcoin will need to stabilize at the current levels to avoid further losses. Whether this support will hold is the key question for ETH/BTC in the coming months.

ETH/BTC’s Longer-Term Outlook

The broader trend of ETH/BTC remains one of relative weakness, especially in comparison to Bitcoin’s stronger performance. Bitcoin has outpaced Ethereum throughout 2023 and 2024, with ETH/BTC unable to establish a clear upward trend. The pair faces significant resistance at the 0.045–0.05 BTC range, further complicating Ethereum’s attempts to outperform Bitcoin.

Indicators show early signs of stabilization but lack confirmation. The MACD’s movement upward suggests a potential shift, but it requires more data to confirm any trend reversal. Similarly, the RSI has shown modest recovery, yet it remains under the neutral level of 50, indicating that Bitcoin still holds dominance.

In summary, ETH/BTC remains in a corrective phase, with Ethereum facing significant challenges in regaining strength against Bitcoin. Whether the support holds or the pair continues to slide remains to be seen, as Ethereum’s performance continues to trail Bitcoin in this extended downtrend.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.