- BNB drops 6.5% in 24 hours, with the MACD confirming a bearish trend.

- Liquidations for BNB reached $8.2M, with long positions seeing the biggest losses.

- BNB remains under pressure, trading within a narrow range of $950 to $1,050.

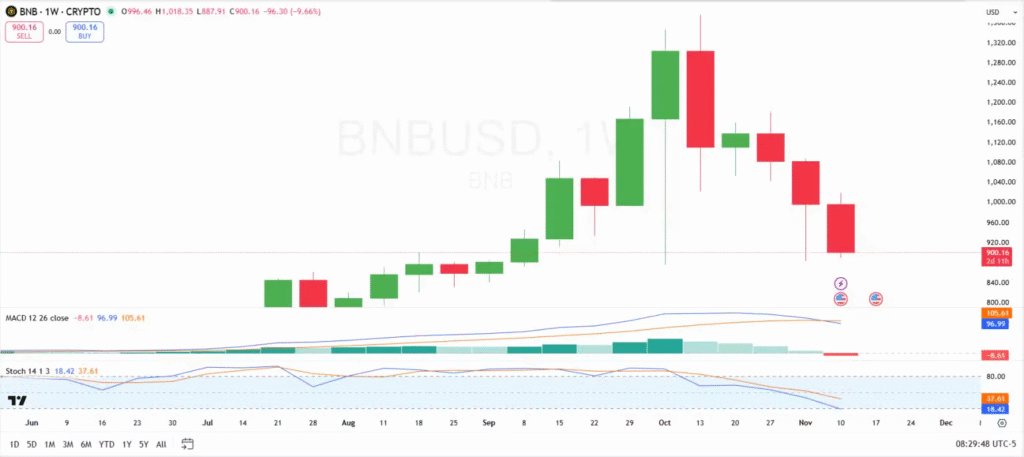

Binance Coin (BNB) continues to experience a downturn in the face of broader market volatility. After closing at $903.69, BNB has faced a 6.5% decline over the past 24 hours. This drop extends to a 16.2% fall over the past two weeks, with the price falling from the early November highs.

Bearish Indicators and Declining Momentum

Looking at technical charts, BNB has faced consistent resistance near $1,138. Despite brief recoveries, the price has failed to stay above key resistance levels.

The Moving Average Convergence Divergence (MACD) indicator also shows a clear bearish trend, with the MACD line remaining below the signal line, suggesting continued downward pressure. The negative MACD histogram further supports the notion of an ongoing downtrend.

Additionally, the Stochastic RSI has entered oversold territory, with the %K line at 18.46. While this signals the possibility of a short-term bounce or consolidation, there is no immediate indication of a bullish reversal.

Liquidation Data Reflects Market Sentiment

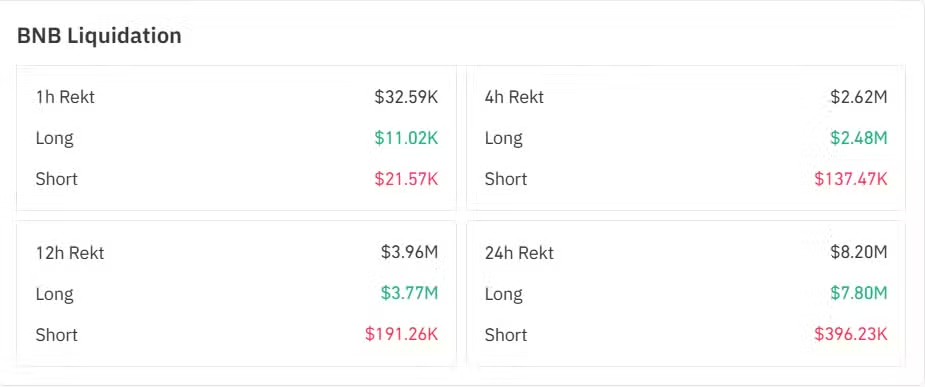

In addition to the technical indicators, BNB has also seen significant liquidations in recent hours. Over the last 24 hours, a total of $8.2 million worth of positions were liquidated, with the majority of losses coming from long positions. This suggests that the market has been pressuring long holders, and bearish momentum is still in play.

The 12-hour and 24-hour liquidation data shows a clear shift in market sentiment, with long positions being the most affected. This aligns with the broader downtrend in BNB’s price action, reinforcing concerns that the token may face further declines in the near term.

Support Levels and Future Outlook

Currently, BNB is trading between $950 and $1,050, indicating a period of consolidation following the sharp drop in October. The support range between $900 and $920 remains crucial for the token’s near-term price action. If BNB fails to hold these support levels, there could be a deeper correction toward $800.

On the other hand, if the price manages to push past the $1,050 resistance, a potential move toward $1,200 could open up. As of now, the market remains in a state of equilibrium, with open interest remaining stable and no major changes in the level of leverage or liquidations.

This suggests a wait-and-see approach for many traders, with the next major move likely contingent on how BNB handles key support and resistance zones in the coming days.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.