- Bitcoin’s short-term holder losses reached $427 million per day, the highest since November 2022.

- Bitcoin dropped 28% from October’s peak, triggering heightened investor panic.

- SuperTrend and death cross indicators signal potential further risks for Bitcoin.

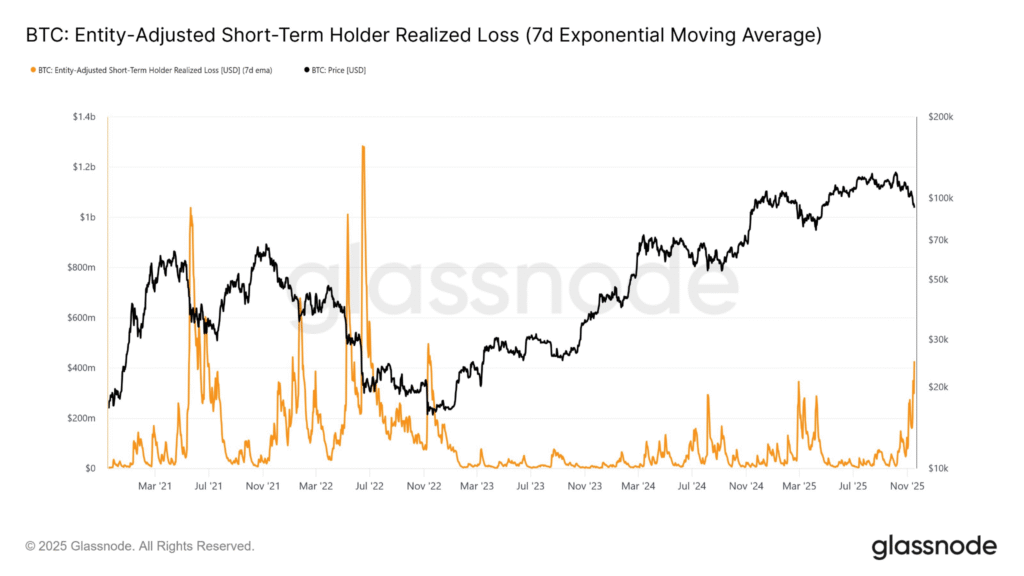

Bitcoin’s price has experienced a sharp drop, leading to an increase in short-term holder realized losses. The 7-day exponential moving average (EMA) for these losses recently hit $427 million per day, the highest since November 2022.

This surge reflects growing panic selling as Bitcoin’s price fluctuates dramatically. The ongoing volatility has led many investors, particularly short-term holders, to sell their assets at a loss.

The drop in Bitcoin’s price has been especially pronounced since October, when it peaked above $124,000. It has since fallen by more than 28%, dipping below $90,000 at times.

This volatility has contributed to rising levels of panic selling, as seen in the recent surge in realized losses. The situation underscores the risks associated with holding Bitcoin during periods of significant price swings.

Bitcoin Price Volatility and Technical Indicators

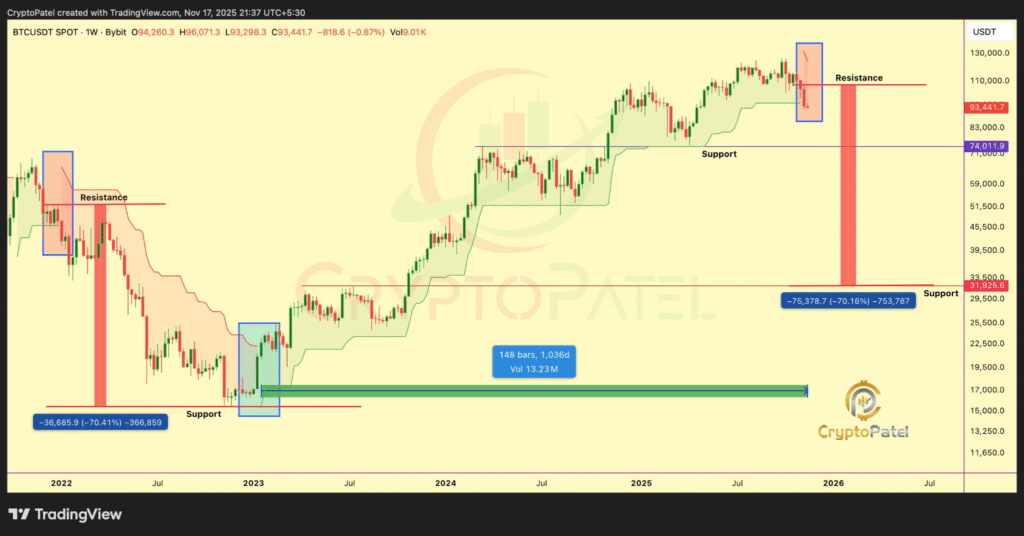

Bitcoin’s price behavior continues to raise concerns among investors, with key technical indicators signaling possible further declines. Crypto analyst Crypto Patel highlighted a shift in the SuperTrend indicator, which recently flipped to a sell signal.

According to Patel, this pattern has often preceded substantial price drops in Bitcoin’s history. He warned that Bitcoin could face a potential decline of up to 70%, pointing to similar technical conditions seen in early 2022.

In addition, the formation of a “death cross” has caught the attention of market observers. This occurs when the 50-day moving average crosses below the 200-day moving average, indicating bearish market sentiment.

Crypto analyst Ali Martinez noted that such crosses often mark local bottoms, but in 2022, they led to the start of a prolonged bear market. These indicators suggest that Bitcoin’s price could face further downward pressure.

Investor Caution Amid Market Uncertainty

Amid these developments, Bitcoin investors are growing increasingly cautious. The recent price swings have triggered concerns about the cryptocurrency’s future direction. Many are watching key technical indicators and price movements closely before making further decisions.

While some analysts anticipate a rebound, others predict continued decline, adding to the uncertainty surrounding Bitcoin’s short-term prospects.

Despite ongoing volatility, Bitcoin remains a focal point for many traders and investors. However, the current market conditions suggest that caution may be warranted as the price remains unpredictable.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.