- Bitcoin ETFs face $71M outflows as investor sentiment turns increasingly cautious.

- Ether funds attract $19M inflows, reflecting growing interest in Ethereum’s utility.

- Market participants monitor macro trends and regulations for future ETF flows.

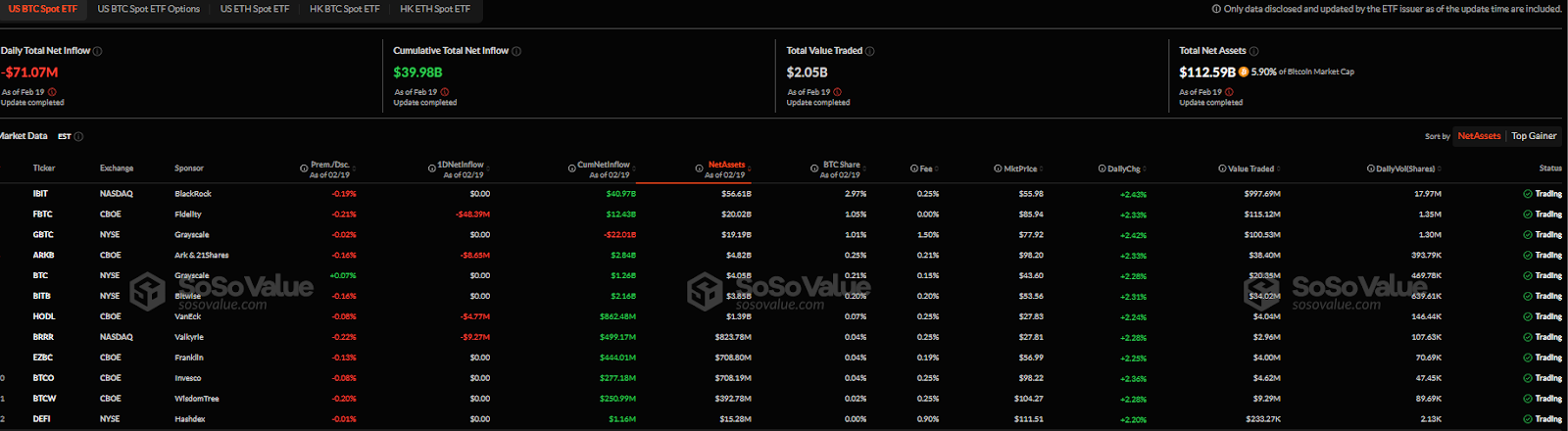

As investors became cautious, Bitcoin ETFs had a $71.07m outflow on Feb 19. Meanwhile, Ether ETFs had a $19.02m inflow as investors became more optimistic about Ethereum funds. Bitcoin ETF assets are still at $112.59b, 5.90% of the market cap, while Ether ETFs have $10.31b in assets, 3.14%. The flows diverge between Bitcoin and Ether ETFs as investors adjust to macro and regulatory headwinds.

Bitcoin ETFs Struggle with Persistent Redemptions

Investors are becoming less optimistic about Bitcoin ETFs. Fidelity’s FBTC had the most significant outflow at $48.99m, reducing its total inflows to $12.43b. Valkyrie’s BRRR had a $9.27m outflow, and Bitwise’s BITB lost $3.98m. BlackRock’s IBIT had no outflow and has $40.97b in total inflows. WisdomTree’s BTCW had a whopping $250.99m inflow. There are pockets of investors who are still optimistic despite overall caution.

Bitcoin was stuck at $96,180.72 and unable to break above key resistance. Analysts are attributing the redemptions to profit-taking and economic uncertainty.

February’s Bitcoin ETF inflows were $644.58 million; outflows were $1.09 billion. This growing gap shows increased caution as traders reassess positions with tightening monetary policies and changing crypto regulations.

Ether ETFs are Rising as Optimism Grows

While Bitcoin ETFs were seeing redemptions, Ether ETFs were seeing inflows. Fidelity’s FETH led with a $24.47 million inflow, and the total inflows are now $1.54 billion. Franklin’s EZET added to the positive sentiment with $37.65 million in total inflows. Grayscale’s ETHE saw $612.18 million in total inflows but a $5.45 million outflow for the day. So, there is mixed sentiment. But overall, Ether ETFs are seeing interest driven by network upgrades and Ethereum’s role in DeFi and NFTs.

Ether ETF assets are now $10.31 billion. Analysts say Ethereum’s use cases attract capital, whereas Bitcoin is a store of value narrative.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.