- Cronos (CRO) price recovers to $0.1146 after whale purchases and market fluctuation.

- Whale investors buy 34 million CRO tokens, suggesting an optimistic market sentiment.

- Technical analysis projects CRO price growth, with a target of $0.3316 by 2026.

Cronos (CRO) recently dropped by 3.11%, settling at $0.1079. This decline occurred over 24 hours, with the price fluctuating between $0.107 and $0.1118.

Despite the drop, there are signs of a recovery in the market as large investors or “whales” have been active in purchasing significant amounts of the token. This buying activity could signal a shift in sentiment towards a more positive outlook for the cryptocurrency.

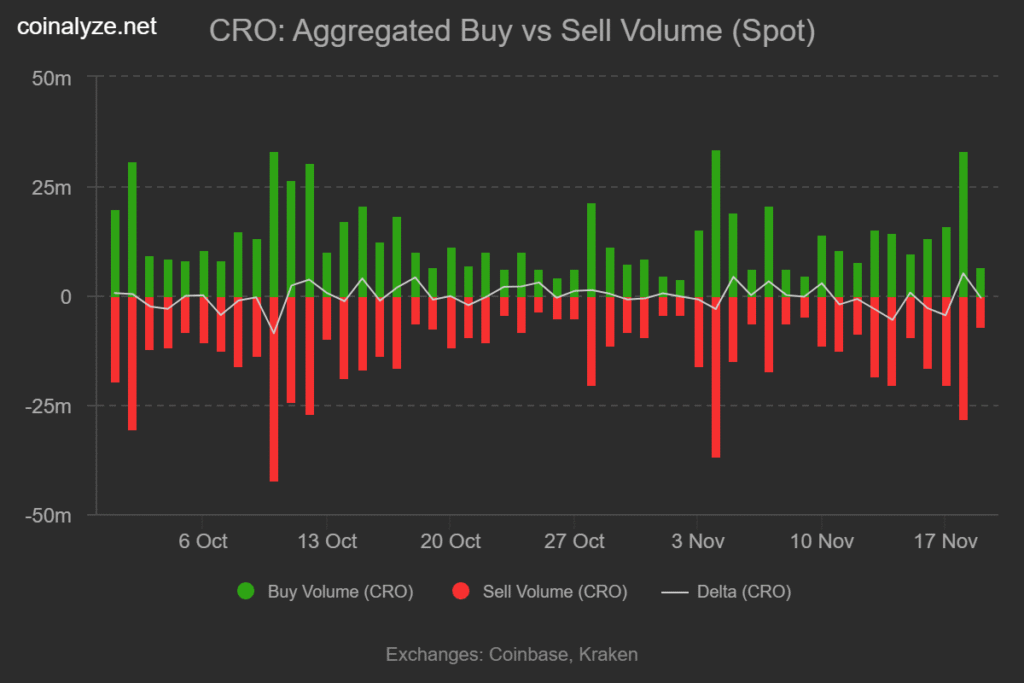

In the last few days, the price has rebounded above the $0.10 level, briefly reaching a local high of $0.1146. According to data from Coinalyze, whales have bought 34 million tokens while only 29 million tokens were sold, creating a positive delta of 5 million tokens.

Additionally, Nansen data reveals that top holders have acquired an average of 211 million tokens, further indicating a shift in market sentiment.

Technical Outlook and Price Projections

A TradingView analysis suggests that Cronos (CRO) could see significant gains over the next few years. The analysis projects a price target of $0.3316, which would represent an impressive 297.24% gain from current levels.

The chart outlines a possible upward trend, with key support and resistance levels identified. The strategy also recommends an entry price around $0.0714, with a stop loss set at $0.0743, offering a favorable risk/reward ratio of 2.95.

The price movement of CRO against USDC is expected to continue its upward trajectory, with the analysis projecting this growth to unfold over the next several years, possibly extending into late 2026.

Exchange Withdrawals and Bullish Sentiment

Recent data from CoinGlass reveals a net outflow of $274,000 from exchanges, indicating that investors are withdrawing their holdings. This trend suggests a positive sentiment within the market, as investors may be looking to hold their assets rather than sell.

Such movements often signal a bullish outlook for the future price of the cryptocurrency. The combination of whale buying activity, long-term projections, and the withdrawal trend from exchanges is helping to strengthen the overall market sentiment surrounding Cronos.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.