- Bitcoin’s price drops by 8% in 24 hours, falling to $84K.

- U.S. bitcoin ETFs see $900M in net outflows amid worsening market conditions.

- Bitcoin’s open interest falls 35% since October, reducing liquidity.

Bitcoin is experiencing its worst monthly performance since 2022, following a sharp drop in its price. As of the latest data, Bitcoin (BTC) is priced at $84,108.08, reflecting an 8.23% drop over the last 24 hours.

The cryptocurrency’s value has consistently decreased throughout the day, falling from a peak of around $91.8K to the current level. This downward trend has erased Bitcoin’s year-to-date gains, pushing the market back to levels not seen since before January’s ETF boom.

The price briefly touched $81,600 before stabilizing at around $84K. This decline has raised concerns about the current state of the cryptocurrency market, especially as the wider macroeconomic environment shows signs of strain.

Declining ETF Flows and Market Liquidity Worsen Bitcoin’s Outlook

Crypto-specific flows are continuing to worsen, with a significant drop in the activity surrounding U.S.-listed Bitcoin ETFs. On Thursday, the funds saw more than $900 million in net outflows, marking their second-worst day since their launch in early 2024.

These outflows reflect growing uncertainty in the market, as investors appear hesitant to commit to Bitcoin and other cryptocurrencies amid ongoing volatility.

Bitcoin’s liquidity is also showing signs of stress, as open interest in perpetual futures has decreased by 35% since its peak in October. The drop from nearly $94 billion in open interest to its current level has further reduced liquidity, making it more difficult for investors to execute large trades without impacting the market price.

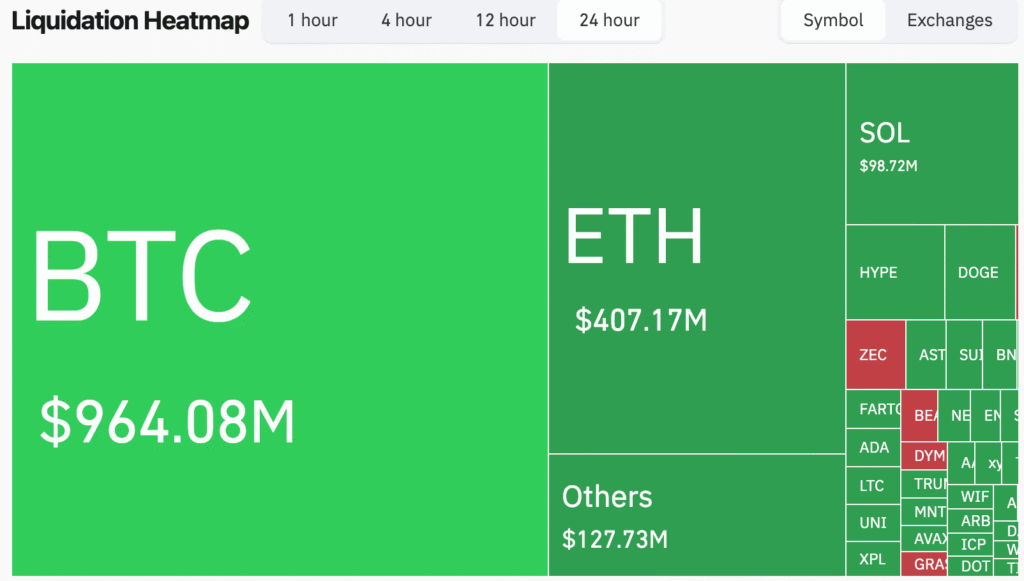

Liquidations and Volatility Continue to Affect Bitcoin Traders

The recent market downturn has led to widespread liquidations, with approximately 396,000 traders getting liquidated. One of the largest liquidations was a $36.7 million Bitcoin position on the platform Hyperliquid.

This high level of liquidation demonstrates the challenges traders face in navigating the current market, as rapid price swings make it difficult to maintain positions.

Despite these challenges, some investors remain committed to holding their positions. Supporters have advised others not to panic sell during these fluctuations, suggesting that Bitcoin could potentially rebound, particularly as it enters what analysts refer to as the “clean bounce zone.” In this zone, analysts expect Bitcoin to rebound after a significant dip, as has occurred during past downturns.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.