- Bitcoin price dipped 30% in November but shows signs of stabilization after positive USDT net flows.

- Hidden bullish divergence spotted on Bitcoin’s chart suggests potential upward movement despite recent selloff.

- Binance and Coinbase bidding on Bitcoin boosts its price to $89,593 amid increased buying interest.

Bitcoin’s price has faced a tough month with a nearly 30% decline from its October high. Recent data points to easing pressures that may help it hold steady. On-chain metrics and exchange activity suggest buyers are stepping in as sellers pull back.

USDT Flows Shift to Support Bitcoin Stability

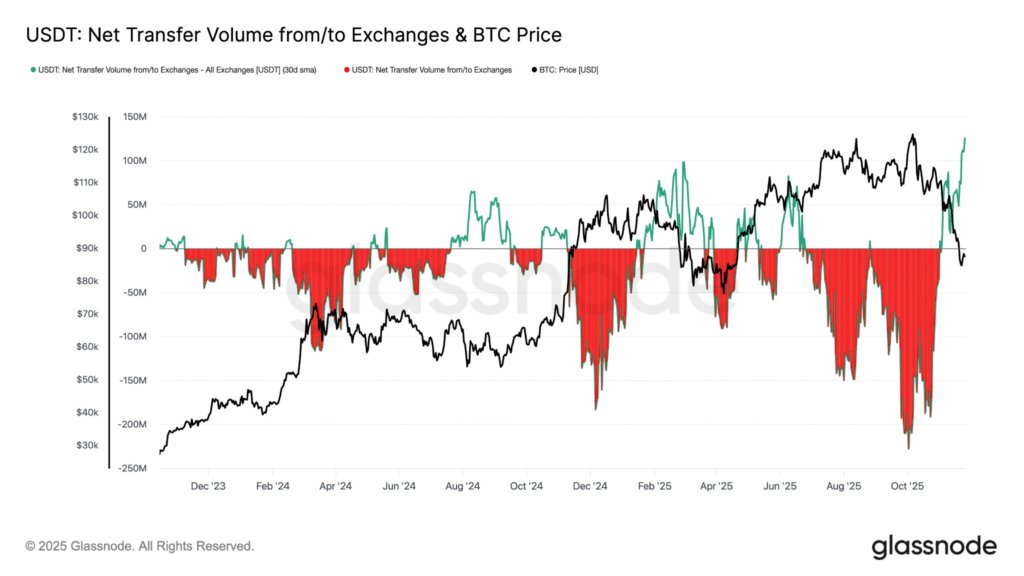

Glassnode examined USDT transfers to exchanges over the past two years. The analysis found a clear negative link between these flows and Bitcoin’s price moves. In high-excitement periods, large outflows often follow as traders cash out gains.

At Bitcoin’s recent top of $126,000, daily USDT outflows hit over $220 million. This pattern matched past peaks where profit-taking ramps up. But as prices fell, those outflows slowed down. Net flows have now gone positive for the first time in weeks.

This change means less USDT is leaving exchanges for sales. More stablecoin stays on platforms, which can boost liquidity for buys. Glassnode noted in their report that such shifts often come when markets calm after hype.

Bullish Divergence Points to Underlying Market Strength

A recent post from analyst Misterrcrypto shared a chart of Bitcoin’s price action. The graph displayed a rising price trend even as the oscillator hit lower lows. This setup forms a hidden bullish divergence, which charts potential buying power beneath the surface.

The divergence appeared during the November dip when Bitcoin tested levels near $82,600. Price held a higher low compared to earlier swings, but the momentum indicator dropped further. Such patterns have shown up before in 2024 and early 2025 recoveries.

Misterrcrypto’s chart used daily candles to spot the mismatch. It suggests sellers are tiring out while buyers build positions quietly. This signal often precedes shifts where price breaks upward after a cooldown phase.

Exchange Bids Fuel Quick Price Bounce on Bitcoin

Analyst TedPillows posted about activity on major platforms last week. He pointed out that Binance and Coinbase showed strong bid walls for Bitcoin. This spot buying pushed the price up sharply to $89,593 in a short burst.

The tweet included a snapshot of order books with bids stacking below current levels. It came right after the market hit a seven-month low of around $82,600. Such bids from major exchanges often attract retail traders and add to upward pressure.

TedPillows wrote, “Binance and Coinbase are bidding on $BTC now.” His update coincided with a volume spike that partially reversed the daily loss. Spot trades like these indicate real demand, not just leveraged bets. The move happened during U.S. trading hours when liquidity peaks.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.