- Injective trades at $6.31, up 3.27% in 24h, with rising volume at 124.85K on Binance.

- RSI reaches 65.09, showing strong momentum as INJ nears upper Bollinger Band at $6.33.

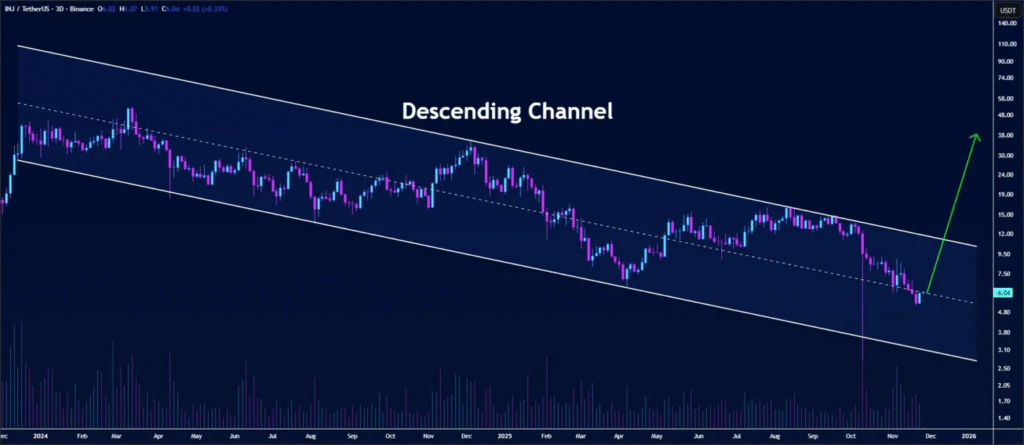

- Analysts identify a wide descending channel with potential breakout above $8 resistance.

Injective (INJ) is gaining attention as it trades near a key resistance level after a steady upward move. With bullish indicators flashing and analysts pointing to potential accumulation patterns, market participants are closely watching the $6.30 zone for a possible breakout that could shift the longer-term trend.

INJ Price Holds Above $6 Amid Recovery Signs

Injective (INJ) is trading at $6.31 at press time it’s reflecting a 3.27% gain in the past 24 hours. The 4-hour chart shows prices pressing near the upper Bollinger Band at $6.33, with the bands beginning to widen, suggesting growing volatility.

The Relative Strength Index (RSI) has risen to 65.09, nearing overbought levels. It has crossed above its moving average of 59.02, which typically signals building momentum. Volume stands at 124.85K, a moderate but steady figure that aligns with the recent price increase.

Buyers have defended the $6.00 level over recent sessions, which now serves as a near-term support. A push above $6.33 could open the door to further upside in the short term. However, a fall below $5.95 could delay bullish developments.

Descending Channel Structure Signals Accumulation Phase

Crypto analyst Butterfly notes that INJ is forming a wide descending channel on the 3-day chart. This pattern has shown multiple retests of resistance, each weaker than the last. The structure often occurs during accumulation phases before a breakout.

The channel’s upper boundary remains a key technical level. If INJ breaks this structure, Butterfly suggests the token could eventually reach the $40 zone.

“Momentum is building and a confirmed breakout may bring price closer to major targets,” the analyst posted on X.

Don, another market analyst, points to a long-term diagonal trendline. This line has tracked the broader INJ decline from 2024 into 2025. It currently lies near $8.00 and serves as a critical resistance. Don suggests that reclaiming this level would mark a shift in trend.

Short-Term Price Outlook Remains Cautiously Positive

In the immediate term, analysts expect INJ to retest the $6.20–$6.30 area. Holding above the $6.00 mark will be essential for sustaining the recent gains.

Breakout confirmation would require a strong close above $6.33, followed by higher volume. If that occurs, traders may look toward the $8.00 level as the next resistance. A failure to hold $5.95, however, would challenge the bullish case.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.