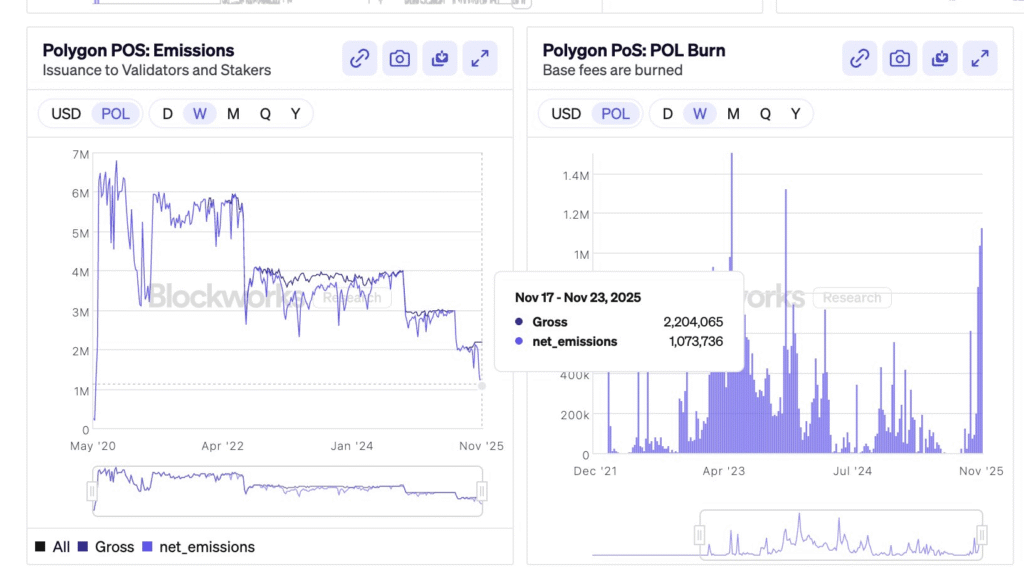

- POL burns over 1M tokens weekly, reducing total circulating supply.

- Net inflation is $140K weekly, lower than most Layer 1s.

- RSI nears 31.77, suggesting POL is approaching oversold territory.

POL, the rebranded token from MATIC, is trading at $0.1338 after a mild 0.5% dip in the past 24 hours. Despite price pressure, recent data on its tokenomics and burn rate suggest the token may be undervalued.

POL Price Weakens as Bearish Momentum Stays

Polygon (POL) is currently facing bearish momentum. The token is trading at $0.1338, down 1.11% in the last 24 hours. The price is near the lower Bollinger Band at $0.1184, showing potential oversold conditions. The resistance levels are set at $0.1472 and $0.1760, indicating the levels where buyers may step in.

The relative strength index (RSI) is at 31.77. This level suggests the token is nearing oversold territory but is not yet reversing.

Price momentum has remained weak over the past week as the broader crypto market consolidates. Technical indicators show that buyers must step in soon to avoid further downside in early December.

Weekly Token Burns Keep Supply Pressure Low

Despite weak short-term price action, POL’s token mechanics remain stable. According to blockchain analyst crypto_vadim, POL burns over one million tokens weekly. This is due to consistent activity on the Polygon PoS network, where users pay transaction fees in POL.

“POL issuance is at its historical low,” said crypto_vadim, adding that “net inflation is just $140,000 per week.”

This low inflation compares favorably to other leading Layer 1 tokens. Many of those projects see higher issuance and less frequent burns, which can increase circulating supply.

Market May Be Mispricing Long-Term Fundamentals

The POL token has transitioned from MATIC and now supports broader use across the Polygon ecosystem. Analysts suggest the market may be underpricing this shift. With staking and high burn rates, POL’s supply growth is nearly flat, which is uncommon among many active networks.

Despite its falling price, the network sees steady usage. This supports ongoing deflationary pressure, which may help price stability over time. Traders watching only technical charts may overlook these on-chain trends.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.