- Lido DAO’s price is testing the key support zone at $0.55, which will determine its next move.

- Lido DAO remains below its 200-day moving average, signaling a bearish trend with further declines likely if $0.55 breaks.

- Despite a price drop, Lido DAO’s trading volume surged by 20.25%, highlighting short-term market speculation.

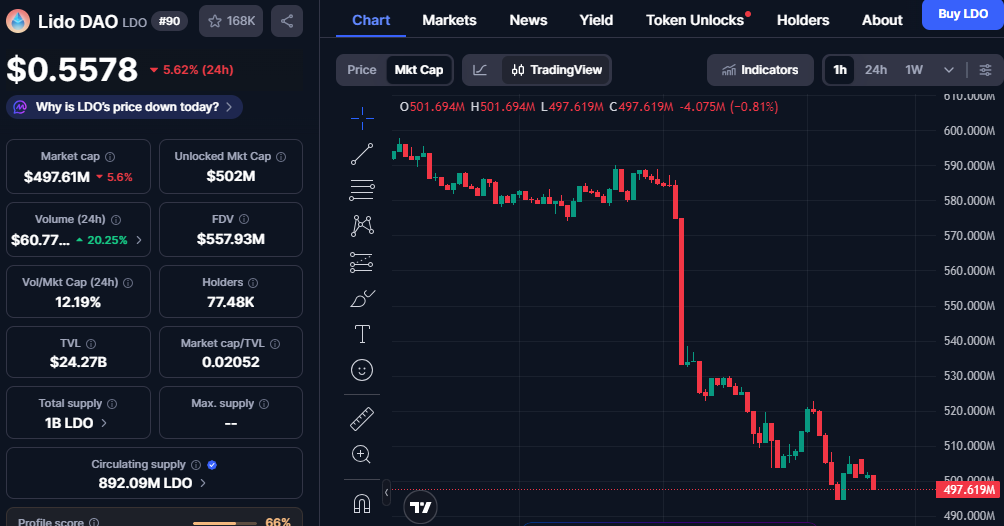

Lido DAO (LDO) is currently testing a key support level at $0.55, a crucial zone for traders. The token’s price has dropped significantly in recent weeks, marking a clear downtrend. Market participants are keenly watching whether this support can hold or if further declines will follow.

Price Action and Technical Indicators Suggest Bearish Sentiment

Lido DAO remains below its 200-day moving average, indicating a bearish long-term outlook. The price has been trapped in a descending channel, with the current price action approaching the lower boundary. This pattern has raised concerns that Lido DAO may continue to fall if the $0.55 level fails to hold.

The market has seen a steady decrease in buying pressure, and volume has dried up near this support zone. Despite a slight recovery attempt, Lido DAO has yet to show signs of a sustained rebound. Traders are eyeing the $0.55 mark as a decisive level that will determine whether the token can stabilize or fall further.

If the price drops below the $0.55 support, Lido DAO could be headed toward the next support levels at $0.50 and $0.45. The market sentiment remains negative, as reflected by the declining price and volume. With no significant positive news, the bearish momentum may continue in the short term.

Lido DAO’s Market Activity and Increased Trading Volume

Despite the recent price drop, Lido DAO’s trading volume has seen a notable increase. The 24-hour trading volume surged by 20.25%, reaching over $60 million. This uptick suggests heightened market activity, likely from traders reacting to the volatile price movements.

Source: Coinmarketcap

This increase in volume does not immediately suggest a reversal but instead highlights ongoing short-term speculation. The rise in activity could indicate that some market participants are trying to capitalize on the price fluctuations. However, the overall trend remains bearish, and Lido DAO’s price struggles to reclaim key levels.

The token’s circulating supply stands at 892.09 million, representing a significant portion of the total supply. This factor plays a role in determining market liquidity and potential price swings. Lido DAO’s market cap has been shrinking, currently sitting at $497.61 million, which adds to the pressure on the price.

Conclusion: Lido DAO’s Critical Decision Point

Lido DAO is facing a pivotal moment in its price action, as traders closely monitor the $0.55 level. The coin has struggled to break above key resistance points and remains firmly entrenched in a downtrend. The next move will be crucial to determining if the market can find support or if further declines are imminent.

With the current price near critical support, Lido DAO’s future direction hinges on the upcoming price action. The next few days will reveal whether the token can bounce from the $0.55 zone or if it will fall deeper into the bear market. Traders are preparing for potential volatility, as this support level plays a crucial role in the token’s price trajectory.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.