- Ethereum’s price may reach $18,000 based on growing institutional interest.

- Long-term holders represent 74% of Ethereum’s total supply, indicating strong confidence.

- Ethereum faces network challenges, but strong demand continues to push prices.

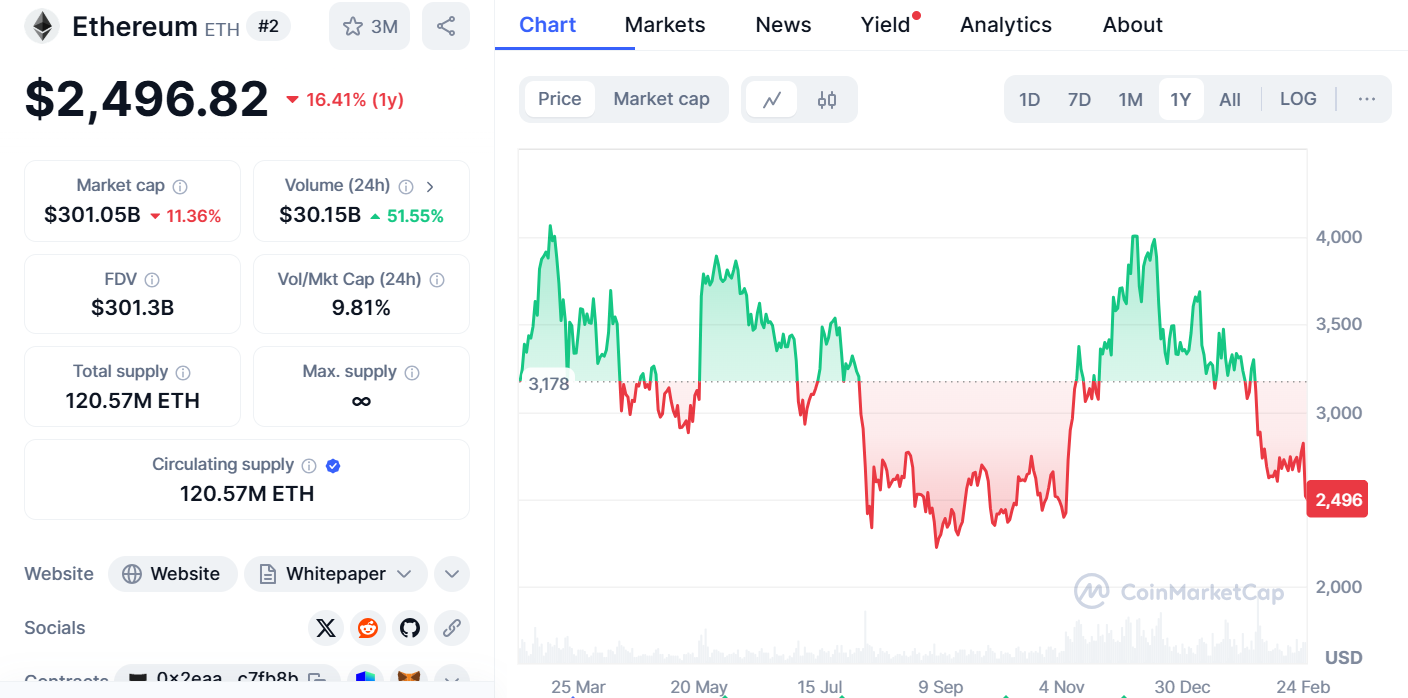

Ethereum (ETH) has been moving through fluctuating market conditions, but recent developments suggest it could experience a significant price surge shortly. Currently priced at $2,496.82, Ethereum is down 10.06% over the last 24 hours. Despite recent challenges, Ethereum’s fundamentals remain strong, and its future price trajectory appears to be leaning toward an ambitious target of $18,000.

Ethereum’s Current Market Performance

Ethereum is currently experiencing some volatility, trading at $2,496.82, with a decrease of 10.06% in the last 24 hours. Ethereum’s market cap is $333.38 billion, reflecting its central role in the global crypto market.

Although its price has fluctuated recently, it has demonstrated strong resilience and solid interest from large holders, with 54% of Ethereum transactions greater than $100K over the last seven days.

A large portion of Ethereum holders, approximately 74%, have held their tokens for over a year, indicating a long-term belief in Ethereum’s growth potential. However, recent data also shows that Ethereum’s correlation with Bitcoin stands at 0.92, suggesting that its price movements are closely tied to Bitcoin’s trends.

Analyst Forecasts: The $18K Price Target

Analyst “Captain Faibik” recently predicted that Ethereum could surge its price to $18,000. According to the analyst, this projection is based on a wedge pattern forming in Ethereum’s chart, which could trigger a breakout.

While this price target may not materialize in the immediate future, it represents the long-term growth Ethereum could experience in the coming years, driven by technological advancements, institutional interest, and increasing demand.

Ethereum’s widespread adoption of decentralized finance (DeFi) and robust smart contract ecosystem make it a strong contender in the crypto space.

Institutional Interest in Ethereum

Institutional investors have increasingly shown interest in Ethereum, with BlackRock’s iShares Ethereum Trust ETF (ETHA) now holding over 1.2 million ETH. This growing institutional adoption is a strong indicator of Ethereum’s long-term potential. In the last seven days alone, Ethereum transactions valued over $100K have totaled $52.01 billion, underscoring the high demand for Ethereum in the market.

With institutional inflows continuing, Ethereum’s market position seems poised for growth. The increased demand from retail and institutional investors could push the price toward the $18,000 target in the coming years.

Bybit Hack and Network Challenges

Recently, Bybit experienced a hack that resulted in the loss of around $1.5 billion worth of Ethereum. However, the exchange has pledged $140 million for recovery efforts, indicative of Ethereum’s ongoing trust within the crypto community. Despite this, the hack highlights the challenges that Ethereum’s complex network faces in handling such incidents. Nonetheless, Bybit has reassured the market by restoring Ethereum reserves and offering a reward to ethical hackers for helping recover the stolen assets.

Ethereum’s Holders and Market Sentiment

Regarding holder composition, Ethereum is seeing strong support from long-term investors. Approximately 54% of Ethereum holders are concentrated in large wallets, while 46% come from regions like East Asia and the West. Moreover, Ethereum holders who have held their tokens for over a year represent 74% of all holders, demonstrating confidence in Ethereum’s long-term value.

However, Ethereum has experienced a decline in total exchange netflows of -$264.52 million over the last seven days. Despite this, Ethereum maintains significant traction due to its innovative ecosystem and increasing institutional interest.

Ethereum’s Bullish Potential

Ethereum is facing both challenges and opportunities in the market. Despite recent price fluctuations and security incidents, Ethereum remains a strong asset with high growth potential. As Ethereum continues to grow its DeFi ecosystem and benefits from institutional adoption, it could reach the $18,000 price target predicted by analysts in the coming years. For those looking to diversify their portfolios with an asset offering both technological advancements and long-term growth, Ethereum remains a strong consideration.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.