- DOGE is testing wedge resistance on the 12-hour chart, signaling a possible breakout.

- 21Shares confirmed a 0.50 percent management fee for its proposed Dogecoin ETF.

- The DOGE ETF will trade as TDOG on Nasdaq if approved by the SEC.

Dogecoin (DOGE) is showing signs of a potential breakout while 21Shares continues to push forward with its proposed DOGE ETF. Technical analysts are watching closely as the asset nears resistance, and regulatory filings suggest the ETF may be listed on Nasdaq under the ticker “TDOG” following SEC approval.

DOGE Tests Wedge Resistance as Breakout Watch Builds

Dogecoin is forming a falling wedge on the 12-hour chart, which often leads to upward movement if resistance is broken. Analyst Clifton Fx shared that DOGE is now attempting to break above the upper trendline of the pattern.

He explained that price action is tightening, and momentum could build if DOGE clears this key level with strong volume.

Traders are monitoring the pattern, and the setup remains valid while support is held. Clifton Fx added that a successful breakout could trigger an 80 to 90 percent price rise.

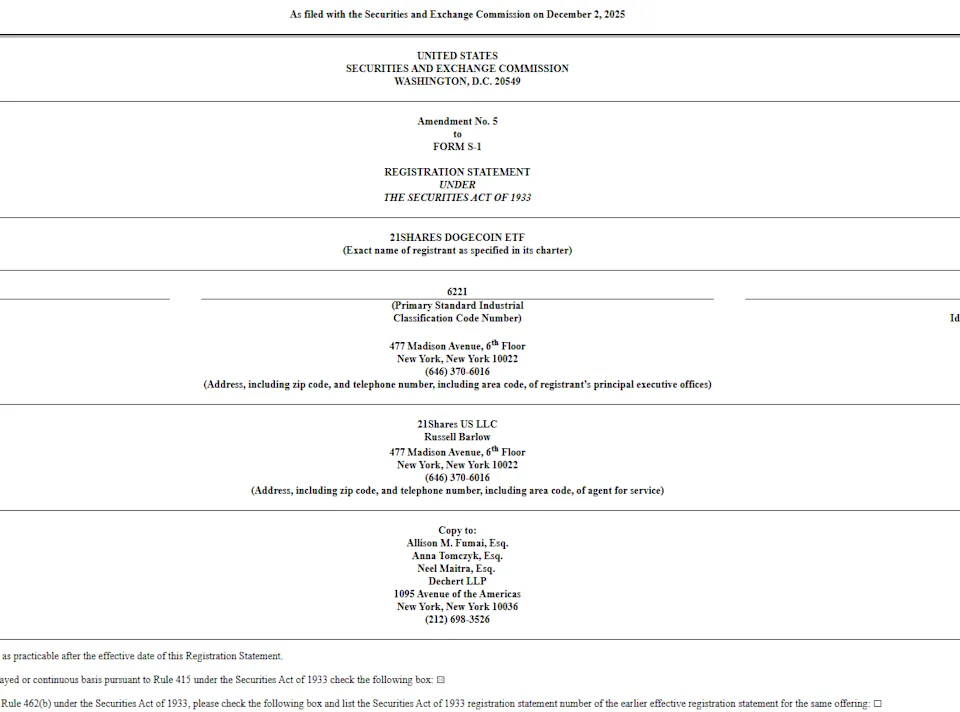

21Shares Submits Updated Filing for Spot Dogecoin ETF

21Shares submitted a fifth amendment to its S-1 filing with the U.S. Securities and Exchange Commission (SEC) for its proposed Dogecoin ETF. The ETF will track DOGE’s market performance based on the CF Dogecoin-Dollar US Settlement Price Index.

According to the filing, the ETF will list on the Nasdaq Stock Exchange under the ticker “TDOG,” pending approval. The trust plans to use $1.5 million to purchase Dogecoin before or at the time of the ETF’s launch.

The amended filing confirms a 0.50% management fee, which will accrue daily and be paid in Dogecoin weekly. 21Shares has not disclosed any fee waivers at this stage.

New Custodian Structure Confirmed in ETF Filing

The updated filing names The Bank of New York Mellon as the ETF’s administrator, cash custodian, and transfer agent. In addition, Anchorage Digital Bank and BitGo will act as custodians for DOGE holdings in the trust.

Coinbase Custody Trust Company was previously proposed, but the change reflects updates in the fund’s structure. 21Shares US LLC will remain the seed capital investor.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.