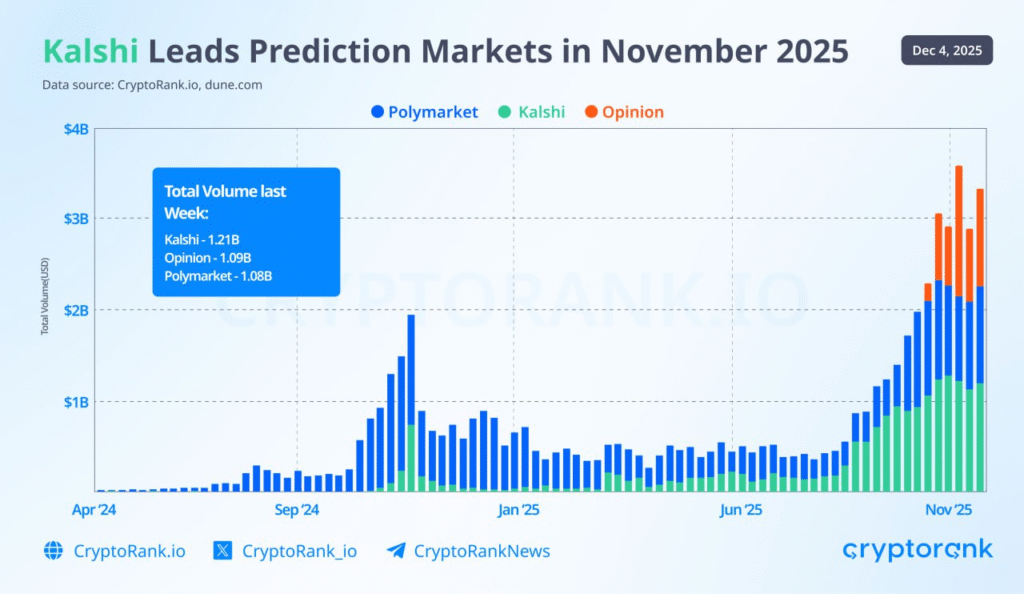

- Kalshi recorded $1.21B in prediction market trading volume during the last week of November 2025.

- Kalshi raised $1B on November 21, 2025, after securing $300M in October.

- Polymarket and Opinion followed closely with $1.08B and $1.09B volumes respectively.

Kalshi led all prediction markets in November 2025 with the highest trading volume. The market saw continued growth, driven by rising investor interest and fresh capital inflows into Kalshi.

Kalshi Leads Prediction Market Volume in November

Kalshi recorded the highest trading volume in the prediction markets during November 2025, reaching $1.21 billion in the last week alone. It outperformed Opinion and Polymarket, which recorded $1.09 billion and $1.08 billion respectively during the same period.

The recent growth in Kalshi’s market activity aligns with a sharp increase in funding. On November 21, 2025, the platform raised $1 billion in a new round, just weeks after closing a $300 million round in October. These inflows appear to have boosted liquidity and trading volume across the platform, increasing its market share.

Data from CryptoRank.io and Dune shows a continuous increase in Kalshi’s market participation since mid-2025. The upward trend also reflects a shift in trader preferences, with more users migrating to platforms with stronger backing and liquidity.

Institutional Funding Drives Market Momentum

Kalshi’s two recent funding rounds have drawn attention from major venture firms. These investments have positioned Kalshi as the top contender in the rapidly expanding prediction market space.

According to CryptoRank.io, the influx of institutional capital is reshaping the competitive landscape. As a result, other platforms like Polymarket and Opinion are also experiencing increased volumes, but at a slower pace. Market activity began to rise steadily from mid-2025 and accelerated sharply in Q4.

The data suggests traders are responding to improved infrastructure and better user experience on platforms with more resources. While Kalshi leads, both Opinion and Polymarket remain active with high weekly volumes close to Kalshi’s.

The total industry volume in November crossed $3 billion, reflecting broader interest in prediction markets. This rise is linked to upcoming political events, economic forecasts, and increased use of on-chain platforms for speculative trading.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.