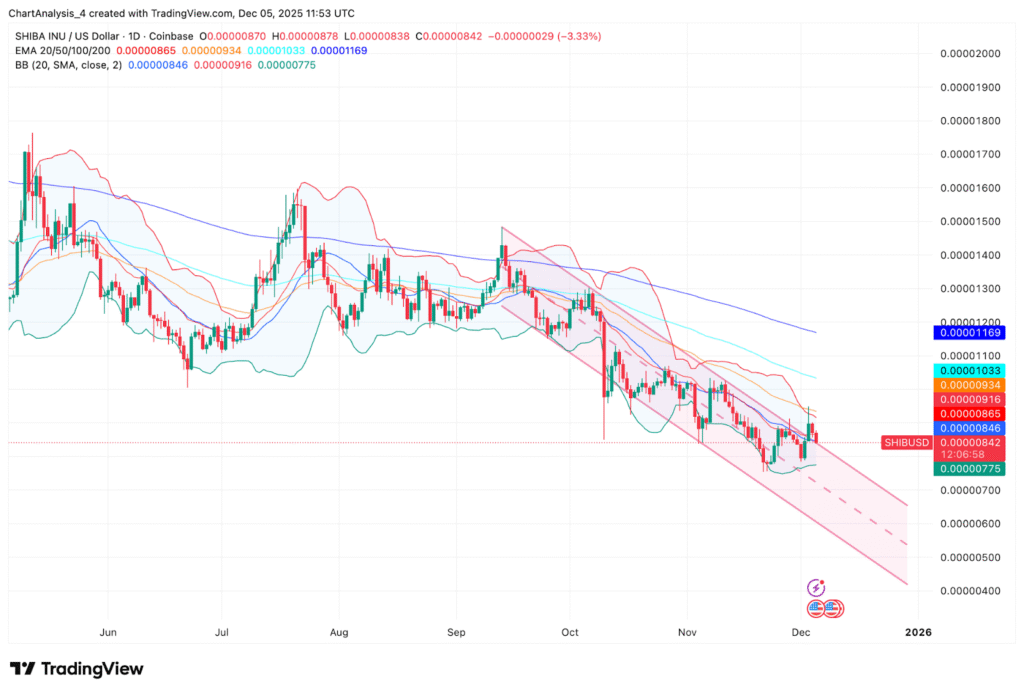

- SHIB price remains under $0.0000086 as bulls fail to break trend resistance.

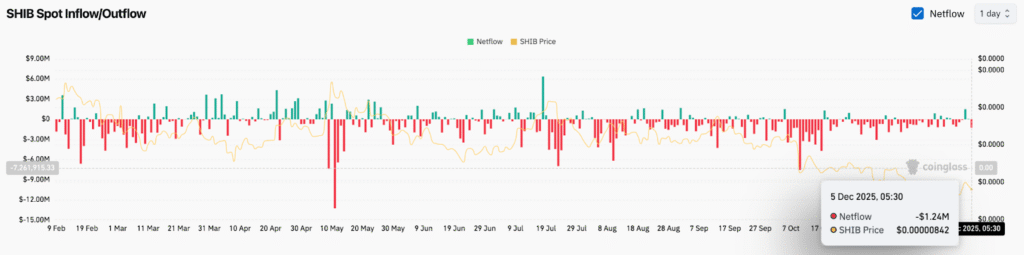

- Spot outflows show $1.24M in SHIB exited exchanges on December 5.

- Price trades below 20, 50, 100, and 200-day EMAs with sellers in control.

Shiba Inu (SHIB) is currently trading near $0.00000842 after a failed breakout attempt earlier this week. The price remains confined within a declining channel that has guided market action since September.

Each upward move has been met with supply from short-term traders instead of fresh demand. The bearish structure has continued to pressure the price lower as the broader trend shows no sign of reversing.

Technical Indicators Remain Bearish Across All Timeframes

SHIB remains below the 20-day, 50-day, 100-day, and 200-day exponential moving averages. This alignment confirms continued weakness, with multiple resistance layers forming above current price levels. The recent rally stalled at the upper Bollinger Band and 20-day EMA before reversing.

The rejection caused SHIB to drop toward the middle of the declining channel again. Price has not closed above the $0.0000086 level, which would be needed to confirm any short-term momentum shift. The area between $0.00000865 and $0.00000934 continues to act as a strong resistance zone.

On the short-term chart, SHIB was rejected from the descending trendline for the second time in a week. Price also dropped below the volume-weighted average price (VWAP) and key intraday support levels. While the relative strength index (RSI) is in oversold territory, there is still no clear buying activity from traders or investors.

Net Outflows Signal Distribution Among Larger Holders

However, Coinglass data shows that SHIB recorded net outflows of around $1.24 million on December 5. This trend suggests that larger holders are selling into weakness rather than accumulating positions. Over the past few months, spot flows have consistently shown more outflows than inflows.

This behavior weakens any short-term rallies because it signals that the current moves are exit points rather than new entry points. Without stronger demand, SHIB’s price remains vulnerable to further downside.

Support levels near $0.0000082 are being tested again, with the next potential level near $0.00000775. SHIB continues to face downward pressure, and unless volume and sentiment shift soon, further declines are possible.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.