- Ethereum is testing key resistance, with analysts predicting a potential reversal.

- Declining spot volumes indicate higher market volatility for Ethereum.

- Analysts are closely monitoring Ethereum for further price direction amid uncertainty.

Ethereum is at a critical juncture as it tests a key resistance zone. Analysts are closely watching for signs of a potential market reversal. With spot trading volumes declining, Ethereum’s price could face increased volatility in the coming days.

Ethereum Faces Resistance Amid Market Shift

Ethereum (ETH) has recently encountered a critical resistance zone, as forecasted by analyst More Crypto Online. This zone has been a key area for potential price reversal, with Ethereum showing early signs of responding to the resistance.

The analyst notes that wave 4 could have formed at the recent price peak, suggesting a shift in market dynamics. With this in mind, Ethereum’s price action could be setting the stage for a potential downturn.

More Crypto Online has indicated that the cryptocurrency’s price movement aligns with previous predictions. The resistance zone is crucial for determining the next phase of market activity.

At press time, the Ethereum (ETH) price is $3,030.62, showing a 3.6% decrease over the last 24 hours.

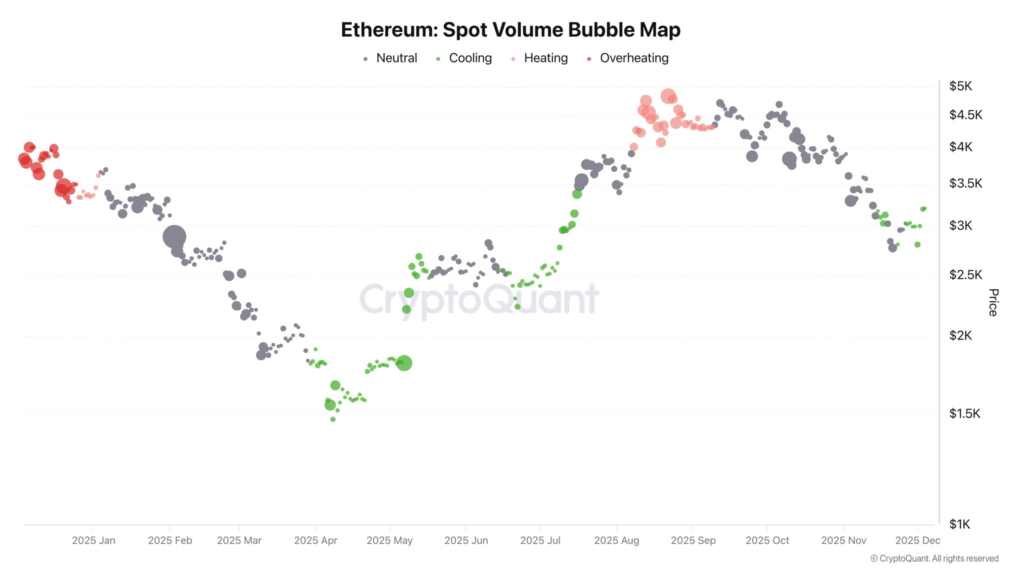

Spot Volumes Decline, Risks of Increased Volatility

However, top analyst Darkfost has pointed out a shift in Ethereum’s market structure. Over recent days, Ethereum has seen a decline in spot trading volumes, even as the price made a slight recovery.

Darkfost notes that this trend weakens the impact of buying and selling activity on the asset’s price, leaving futures markets to play a more dominant role in the price direction.

Spot volume weakness increases the risk of heightened volatility. The analyst explains that with fewer buy and sell orders available, sudden market moves become harder to absorb. This creates an environment where futures-driven momentum can have a larger impact on price fluctuations.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.