- BNB’s price is near the lower Bollinger Band, signaling potential market reversal.

- RSI at 44.72 suggests Binance Coin is nearing oversold territory.

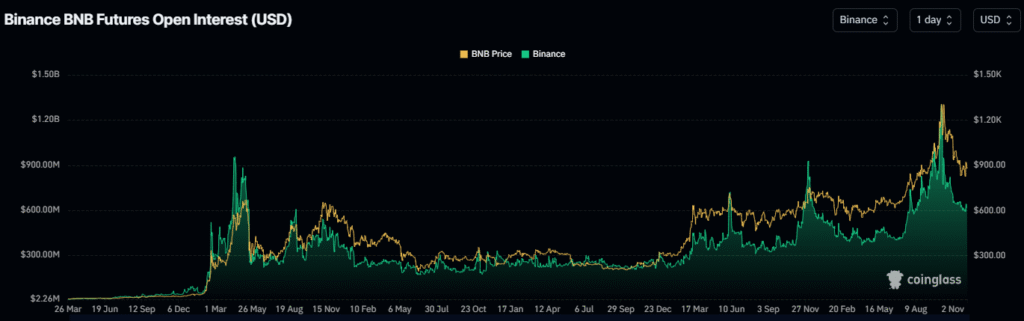

- Binance’s open interest in futures mirrors price trends through December 2025.

Binance Coin (BNB) has shown signs of market stagnation. The coin is trading at $879.60, facing a minor decline of 0.58%.

Despite the recent drop, broader market conditions suggest a potential price reversal or further consolidation in the coming days. This slight decrease in price has occurred amidst low volatility, as evidenced by the Bollinger Bands, which suggest a tightening market.

Additionally, the Relative Strength Index (RSI) stands at 44.72, approaching the oversold threshold. A reading near this level often signals that the asset is undervalued, which could prompt buying activity if the price moves upward.

Binance Coin Futures Open Interest Trends

Binance Coin Futures Open Interest (USD) reveals notable trends in the market. The surge in open interest observed between March and April 2023 directly coincided with large fluctuations in BNB’s price.

According to Coinglass data, both BNB’s price and the open interest followed similar patterns, with open interest peaking during periods of high price fluctuations. This suggests a strong correlation between futures market activity and BNB’s underlying price movements.

As of December 2025, open interest remains relatively high, indicating that market participants are still actively trading Binance Coin futures. Although open interest rose sharply in early 2023, the overall trend has been a slight decline.

Market Outlook and Potential for Breakout

Given the current market conditions, the focus remains on the possibility of a breakout or further price consolidation. Traders are particularly focused on the interaction between BNB’s price and the Bollinger Bands.

If the price moves above the lower band, it could indicate a potential reversal toward higher levels. Conversely, sustained pressure at the lower band may signal continued consolidation before any major price movement.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.