- VeChain (VET) is testing crucial support between $0.013 and $0.015, with potential for a reversal if this holds.

- RSI bouncing from oversold levels and MACD flipping positive suggest that VeChain could be poised for an upward move.

- Analysts project VeChain could reach $0.050-$0.060 in the short term and $0.250 in the long term, offering significant upside potential.

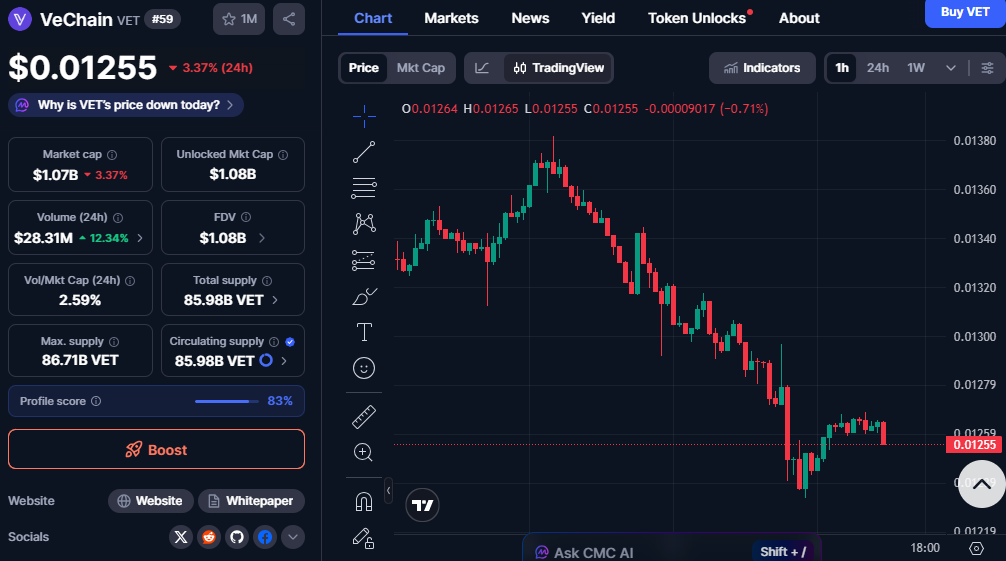

VeChain (VET) is currently testing critical support levels after a prolonged downtrend, with the price showing signs of potential reversal. The price is trading around $0.01255, reflecting a 3.37% drop over the past 24 hours. However, technical analysis suggests that breaking through key resistance levels could set the stage for a strong upward movement.

Technical Outlook for VeChain (VET)

VeChain (VET) has been in a multi-year downward trend, currently forming a falling wedge and range bottom pattern. This setup suggests that the cryptocurrency might be nearing a bottom after a 95% decline from its all-time high (ATH). The price is now testing a critical horizontal range low between $0.013 and $0.015, which is seen as a key support zone for any potential reversal.

Source: Coinmarketcap

The recent weekly hammer close below the 200-week moving average (MA) further supports the theory of capitulation. If the price stays above this range, the likelihood of a bullish reversal increases, with the potential to break resistance levels. Indicators such as the RSI bouncing from deeply oversold levels and the MACD flipping positive signal that VeChain may soon experience a price uptick.

VeChain’s volume is also a noteworthy factor, sitting at multi-year lows, which could indicate that the market is undergoing accumulation. This low volume at price lows traditionally precedes major breakouts, further suggesting a bullish scenario. If VeChain holds above the current range and breaks resistance, it could see a significant rise in price.

Price Targets and Long-Term Potential

VeChain’s breakout targets are set between $0.030 and $0.035, and analysts foresee the price reaching $0.050 to $0.060 should it break these levels. A move beyond $0.060 could lead to a higher target range of $0.100 to $0.120 by mid-2026. Long-term, VeChain’s price could rise to $0.250 or more, marking a full cycle top and offering significant upside potential for those who enter at current levels.

https://twitter.com/AltcoinPiooners/status/1996912446431547881?s=20

However, the long-term outlook remains contingent on maintaining critical support levels. If VeChain closes below $0.010 on a monthly basis, the bearish trend could extend, potentially invalidating the bullish scenario. The next few months will be critical in determining whether VeChain can maintain its current support or break out of its multi-year pattern.

Current Market Performance of VeChain (VET)

In terms of recent performance, VeChain (VET) is showing signs of consolidation at its current price of $0.01255. The trading volume has dropped by 12.34% in the last 24 hours, indicating reduced market participation. Despite the drop, the market cap of VeChain stands at $1.07 billion, with a circulating supply of 85.98 billion tokens.

The price chart suggests a narrow trading range, which indicates market consolidation. If VeChain fails to maintain key support at $0.013, further downside could follow, though the bullish outlook still holds if the market conditions improve. The cryptocurrency’s ability to break above resistance and move towards the higher targets could lead to significant gains.

Conclusion

VeChain (VET) is testing critical price levels, and technical indicators suggest the potential for a strong reversal if resistance is broken. The cryptocurrency’s multi-year downtrend may soon give way to a bullish rally, especially if key support holds. While there is a possibility for further downside, VeChain’s longer-term outlook remains positive, with significant upside potential if market conditions align.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.