- TRON’s USDT supply has surged to 4 billion, marking record adoption.

- Rising transaction costs have made TRON one of the most expensive networks.

- TRON’s gas-free feature aims to eliminate TRX fees for USDT transfers.

TRON’s USDT supply has reached an all-time high, signaling rapid adoption. More users are moving liquidity to TRON for transactions and DeFi activities. The volume of USDT transactions on TRON-based exchanges has surged. In 2020, it fluctuated between 50 million and 500 million, but today it stands at 4 billion. On-chain transactions have increased fivefold compared to centralized exchanges, reinforcing TRON’s decentralized nature.

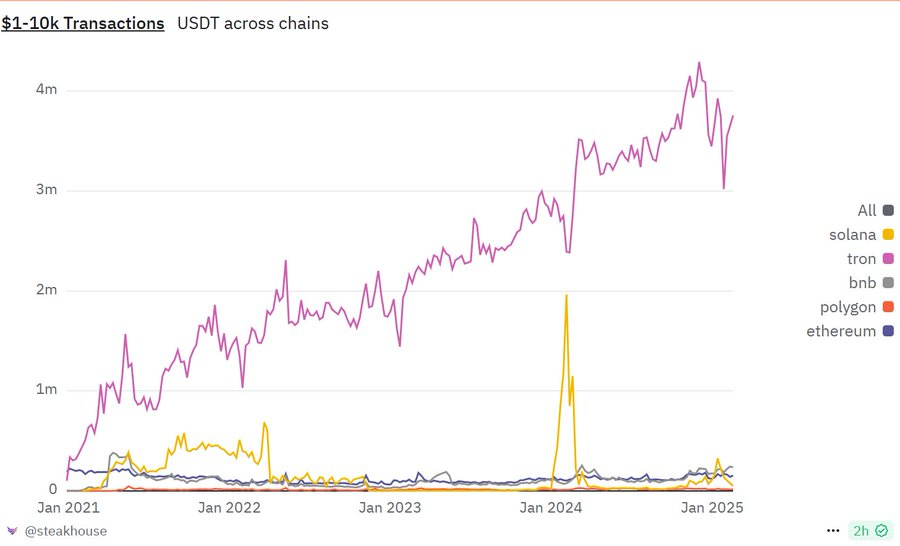

TRON Leads in Small-to-Mid-Sized USDT Transfers

TRON continues to dominate USDT transactions within the $1,000-$10,000 range.

Data indicates TRON maintains a significant lead over other blockchains for these transfers. Trondao remains the preferred network for users executing frequent, small-to-mid-sized USDT transactions. This trend underscores TRON’s growing role in stablecoin adoption.

USDT Growth and TRON’s Market Position

The increasing USDT supply on TRON highlights its rising market relevance. Many users prefer TRON due to its speed and affordability for stablecoin transfers. However, transaction fees have surged.

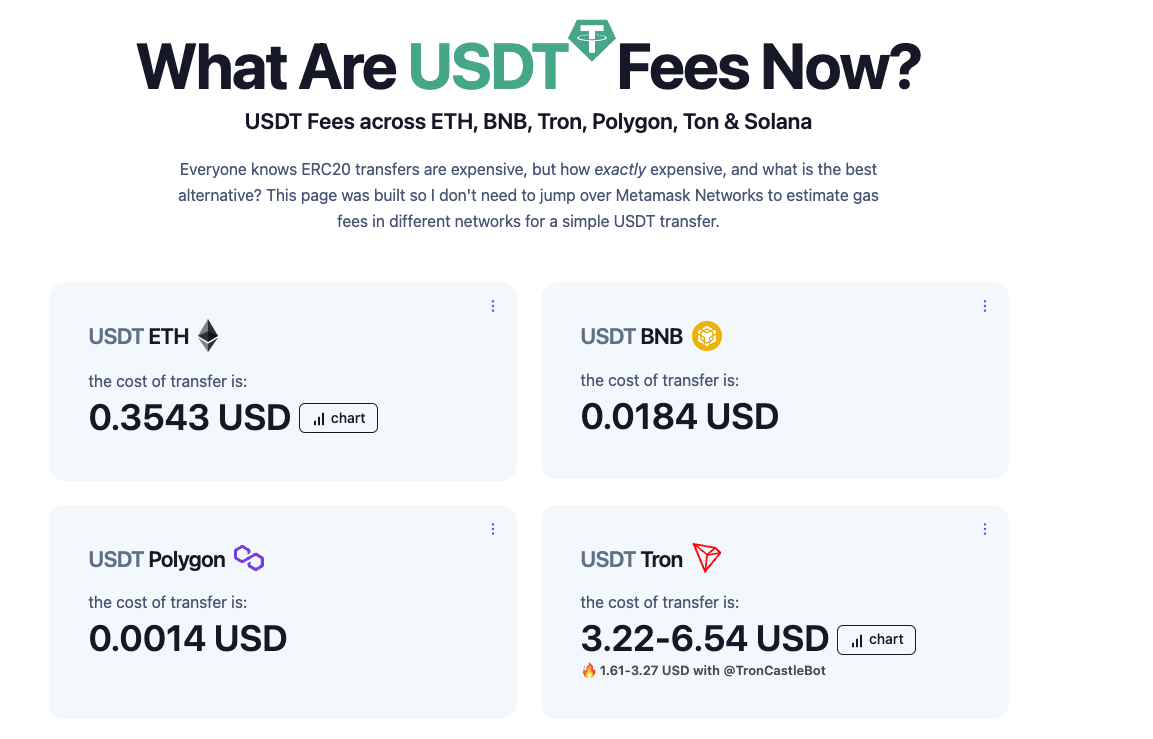

According to Tether’s GasFeesNow, TRON’s TRC-20 USDT transactions currently have the highest fees among supported blockchains. While Ethereum’s ERC-20 USDT fees hover around $0.40, TRON’s TRC-20 fees range between $3.20 and $6.50 per transaction.

TRON’s Gas-Free Initiative and Its Impact

In response to high fees, TRON founder Justin Sun announced the launch of a “Gas Free” feature. This update, expected within a week, eliminates the need for TRX tokens to pay gas fees for USDT transfers. The move aims to restore TRON’s reputation as a low-cost blockchain for stablecoin transactions.

Sun also invited teams and wallets to integrate the feature by reaching out to JustLend, TRON’s official lending platform. A JustLend spokesperson confirmed that an official announcement regarding the gas-free initiative is imminent. Industry analysts suggest that this innovation could improve adoption and make TRON more appealing than Ethereum and other EVM-compatible networks.

TRX Market Reaction and Future Outlook

Despite the announcement, TRX prices fell over 7% in 24 hours, trading at $0.2305, slightly below its 20-day EMA of $0.2389. Analysts cite high transaction fees and market sentiment as factors affecting price movement. TRX’s RSI is currently at 43.73, signaling oversold conditions. A successful rollout of the gas-free feature could boost confidence and drive bullish momentum.

TRON’s stablecoin market position remains strong. The network added approximately $824 million in USDT and USDC holdings in February 2025 alone. With TRON maintaining its rank as the second-largest stablecoin network after Ethereum, the gas-free feature could further strengthen its position.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.