- Negative sentiment around Microstrategy may signal an upcoming price rebound in the crypto market.

- Memes and growing skepticism about Saylor’s strategy could be a contrarian indicator for Bitcoin prices.

- Microstrategy’s stock drops, but Saylor’s new “capital markets platform” pitch aims to revive its fortunes.

Microstrategy Faces Scrutiny Amid Shift in Market Sentiment

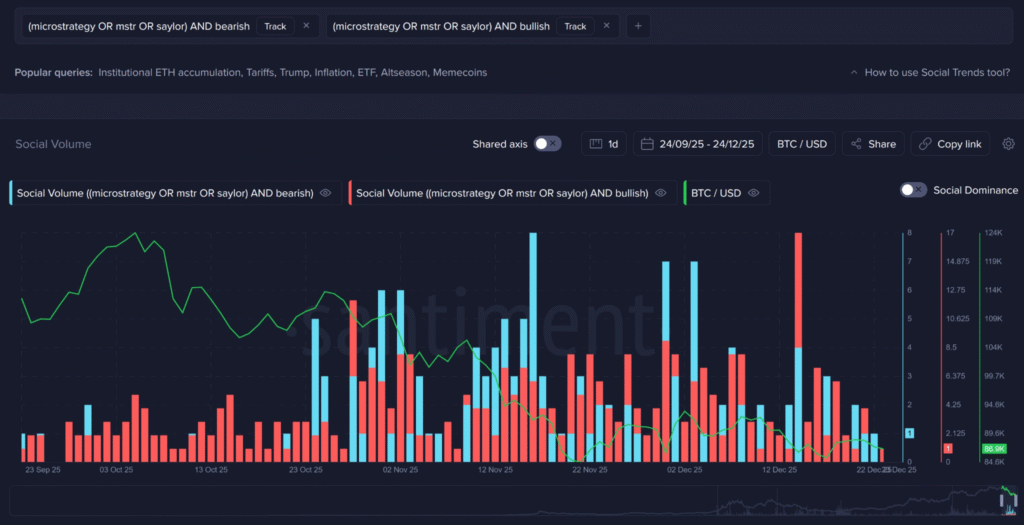

As 2025 progresses, Microstrategy, led by Michael Saylor, is increasingly under scrutiny from the crypto community. Recent data from Santiment reveals a noticeable shift in sentiment, with growing negativity toward both Saylor and his Bitcoin strategy.

While skepticism about Microstrategy’s investment strategies is on the rise, there may be an underlying trend suggesting a potential market reversal. According to Santiment, the surge in negative sentiment and the increase in memes about Saylor and Microstrategy could signal that the market is nearing a bottom.

In past instances, such a rise in negative sentiment has often been followed by a price rebound in the broader crypto market, suggesting that the current situation might set the stage for a price bounce.

Saylor’s Strategy and Recent Stock Performance

Despite the mounting criticism, Saylor has continued to push forward with Microstrategy’s Bitcoin acquisition strategy. The company has purchased over 10,600 Bitcoin in each of its last two weekly buys, marking a significant acceleration in its Bitcoin accumulation pace.

Saylor has been vocal about his strategy, recently sharing a cryptic message on social media: “Green dots beget orange dots.” This phrase can be interpreted as an indication that MicroStrategy intends to continue buying Bitcoin in large quantities.

However, this strategy has not been without consequences. The company’s stock has experienced a significant decline in recent months, dropping by more than 45% year-to-date.

This decline contrasts with Bitcoin’s more modest drop of around 6% in the same period. As retail sentiment on platforms like Stocktwits has turned notably bearish, some investors are concerned that Microstrategy may be forced to sell its Bitcoin holdings, further weighing on the stock price.

In response to these concerns, Saylor has attempted to reframe the company’s narrative, now positioning Microstrategy as a “capital markets platform” rather than solely a Bitcoin-focused business.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.