- Ethereum’s price at $2,980 could signal long or short trade opportunities.

- Short-term trends show downward pressure, indicating possible continued declines.

- Ethereum faces strong resistance at $3,000–$3,100, limiting bullish momentum.

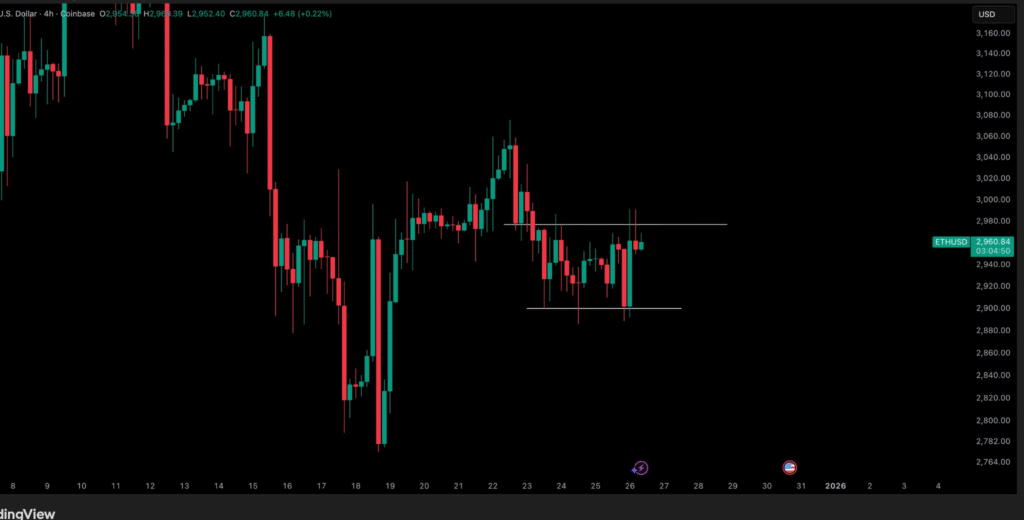

Ethereum (ETH) traders are keeping a close watch on the $2,980 price point as a potential turning point for the cryptocurrency. Crypto Tony’s analysis suggests that if Ethereum reclaims this level, it may present an opportunity for traders to enter long positions.

On the other hand, a failure to hold or move past $2,980 could signal weakness, making short trades a potential strategy.

After reaching a low of $1,373 in April, Ethereum experienced a strong recovery and surged to a record high of $4,950 in August. However, the recent crypto market crash, coupled with Ethereum ETF outflows, has caused its price to decline to $2,950.

The $2,980 level, as highlighted by Crypto Tony, stands as a crucial area to determine the next steps for Ethereum’s price movement.

Short-Term Trends Point to Continued Downside Pressure

On the shorter timeframes, Ethereum’s price action is showing signs of weakness. Analyst Lennaert has highlighted a downtrend visible on the 1-hour chart, where Ethereum has faced repeated rejections near the $2,990 level.

The price has recently dropped below the $2,900 mark, which signifies a breakdown in support. This pattern, characterised by lower lows and reduced volatility, suggests that Ethereum may continue to face downward pressure in the near term.

The lack of significant bullish momentum and fading volatility further adds to the downside risks for Ethereum. As the cryptocurrency market remains uncertain, these short-term trends indicate that ETH may struggle to reclaim its upward trajectory unless stronger buying pressure emerges.

Ethereum Faces Repeated Resistance at $3,000–$3,100

Ethereum has consistently encountered resistance in the $3,000–$3,100 range since July 2025. Analyst Ted noted that each attempt to push above this resistance level has been met with pullbacks, leading to declines toward the $2,800 support zone.

This pattern of lower highs suggests that bullish momentum is weakening, as the price has been unable to break past the established resistance despite several attempts.

This persistent resistance indicates Ethereum is higher, and the overall market sentiment remains uncertain. For Ethereum to show any signs of sustained recovery, it will need to decisively break through the $3,000–$3,100 resistance zone, which has proven challenging in recent months.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.