- Bitcoin moved above $90K before falling below $87K after Christmas

- A large trader opened over $250M in leveraged bearish crypto positions

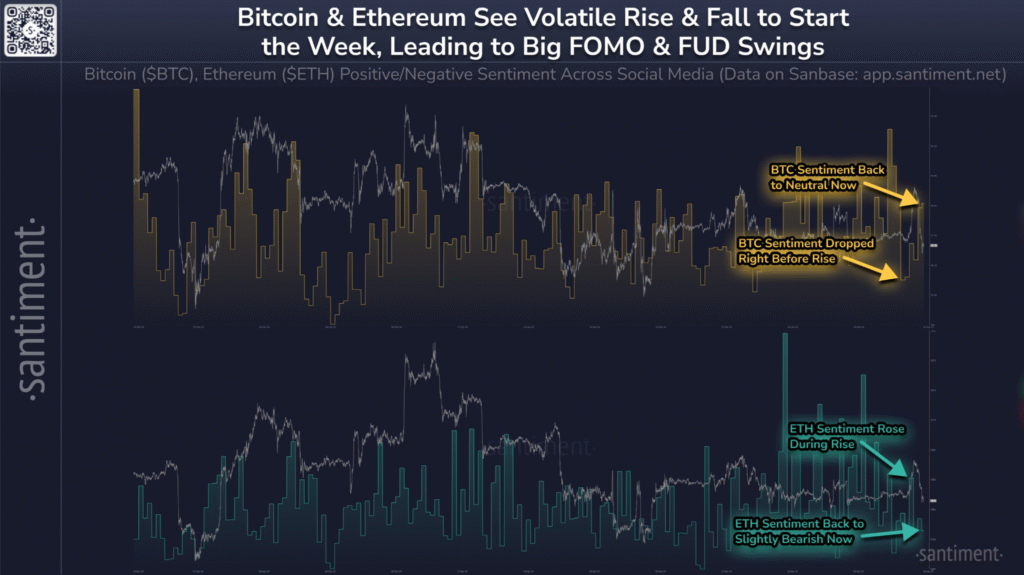

- Ethereum sentiment improved during the rise but later turned bearish

Bitcoin surged above $90,000 following the Christmas weekend before reversing lower. The price later dropped below $87,000 as traders reduced risk exposure. Market data showed rising fear and uncertainty during the brief rally.

Bitcoin is trading near $87,650, down about 0.29% in the past 24 hours. Lower liquidity during the holiday period contributed to faster price changes. Trading conditions remained orderly despite the pullback.

Santiment data showed negativity rising before the rebound. Sentiment later returned closer to neutral as prices eased. This pattern has appeared during previous short term moves.

Ethereum followed a similar path but with a different timing in sentiment. Positive sentiment increased during its price rise. It later shifted back to slightly bearish levels.

Derivatives Activity Adds Pressure to the Market

On December 29, a large crypto trader expanded bearish positions across major assets. Lookonchain reported new Bitcoin shorts worth about $119 million. Ethereum and Solana shorts totalled about $149 million combined.

The positions were opened using perpetual futures contracts. This showed a strategy focused on derivatives rather than spot selling. The total exposure exceeded $250 million within a short time.

Such activity can influence short term price action during low volume periods. Other traders often respond by reducing exposure. This can limit recovery attempts.

ETF outflows also affected spot demand. U.S. investors showed limited buying interest during the decline. This reduced support at higher price levels.

Macro Signals Shape Market Direction

Bitcoin prices were also influenced by changing expectations for interest rates. Recent comments from Federal Reserve officials suggested a cautious approach to rate cuts. Expectations for January easing declined.

Higher interest rates tend to pressure risk assets, including digital assets. Traders adjusted positions in response to these signals. This kept prices within a narrow range after the drop.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.