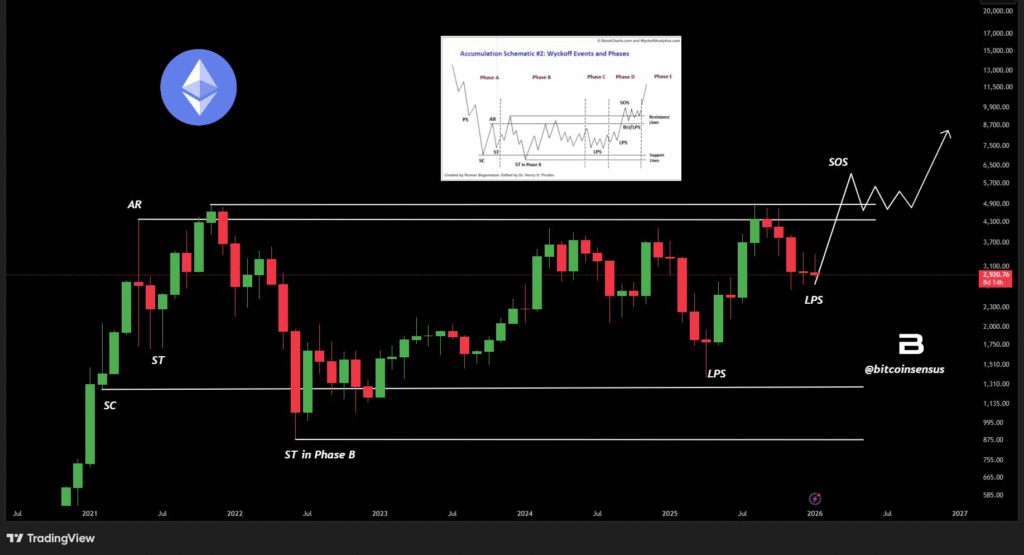

- Ethereum shows a textbook Wyckoff accumulation pattern on the monthly chart.

- A Last Point of Support (LPS) may confirm a breakout phase in ETH’s structure.

- Analyst Bitcoinsensus expects ETH to rally above $5,000 after SOS breakout.

Ethereum May Be Entering Breakout Phase in Wyckoff Pattern

Ethereum’s current price structure appears to follow the Wyckoff Accumulation model, based on a chart shared by analyst Bitcoinsensus. The analysis identifies several key Wyckoff phases that may indicate Ethereum is preparing for a strong move.

According to the chart, ETH may have printed its Last Point of Support (LPS), a critical phase that often comes before a breakout. The Wyckoff Accumulation model is a technical pattern that shows how assets move from a downtrend to an uptrend through accumulation by large investors.

The chart shows events such as the Selling Climax (SC), Automatic Rally (AR), and Secondary Tests (ST), which have occurred over the past years. These events match the classic structure of Wyckoff’s schematic.

The structure points to Ethereum being in the later part of Phase D, where prices hold support and prepare for a rally. The analyst notes, “The current structure shows a textbook Wyckoff pattern,” suggesting a strong foundation may have formed before a potential uptrend.

ETH Targeting $5K After Confirmed Support Level

Ethereum is currently priced near the $2,400–$2,500 range, according to the chart, but a move above the resistance zone could trigger further gains. A breakout above this level is known as the Sign of Strength (SOS) in Wyckoff analysis, which is often followed by a price surge. If this occurs, Ethereum could climb to over $5,000 in the coming months.

The chart includes a projection showing ETH consolidating briefly above the resistance zone before trending higher. This projection matches the Wyckoff pattern’s expected price behavior. The Last Point of Support (LPS) suggests that buyers are absorbing supply before the next phase begins.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.