- 80% of institutions plan to buy or hold if crypto falls by another 10%.

- 60% of institutions have held or added to crypto since October highs.

- Only 8% of retail investors would reduce their crypto exposure in a dip.

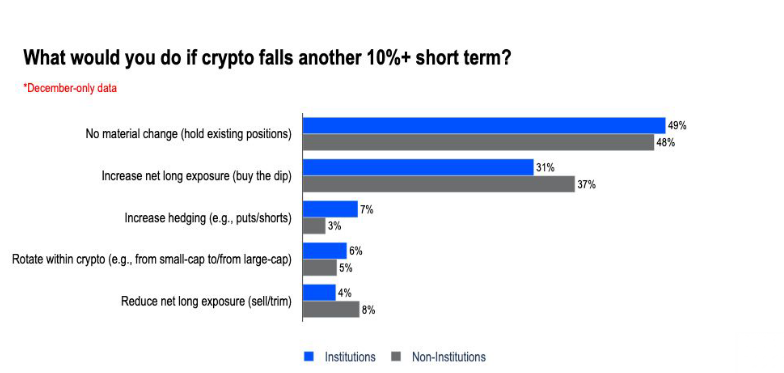

Coinbase has revealed how investors, both institutional and retail, may respond to a further 10% drop in crypto prices. This data, collected in December, shows that most investors plan to hold or increase their positions even during short-term market downturns.

According to the survey, 49% of institutional investors reported they would make no changes and continue holding their current crypto assets. In addition, 31% of them said they would buy more during the dip. On the other hand, 48% of non-institutional (retail) investors also chose to hold, while 37% showed willingness to increase their exposure.

This trend suggests that many investors still have long-term trust in digital assets like Bitcoin, despite short-term price fluctuations. A post by Coin Bureau noted that over 60% of institutional investors have either held or increased their crypto holdings since October, when Bitcoin last reached an all-time high.

Hedging, Reducing, and Rotating Strategies Less Common

While the majority are staying invested, only a small portion are taking more defensive or tactical approaches in the face of market uncertainty. Just 7% of institutional investors said they would increase hedging activities, such as using puts or short positions. Among retail investors, this number was even lower, at 3%.

Some investors considered shifting their positions within the crypto market rather than exiting it. Specifically, 6% of institutional investors and 5% of retail investors said they would rotate between small-cap and large-cap crypto assets.

Meanwhile, reducing exposure was the least chosen option among institutions. Only 4% said they would cut back their holdings. However, among retail investors, the figure was slightly higher at 8%, still showing that most are not planning to exit the market.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.