- Bitcoin rejected 94k-98k resistance, confirming a bearish structure and downside risk.

- Bitcoin’s trend remains bearish, with supports at $80k, $75k, and $70k.

- A bullish reversal only happens if Bitcoin reclaims levels above $92k.

Bitcoin has confirmed a bearish trend after rejecting key resistance levels. The failure to break through the $94k–$98k range points to potential downside. With support levels at $80k, $75k, and $70k, further declines seem likely.

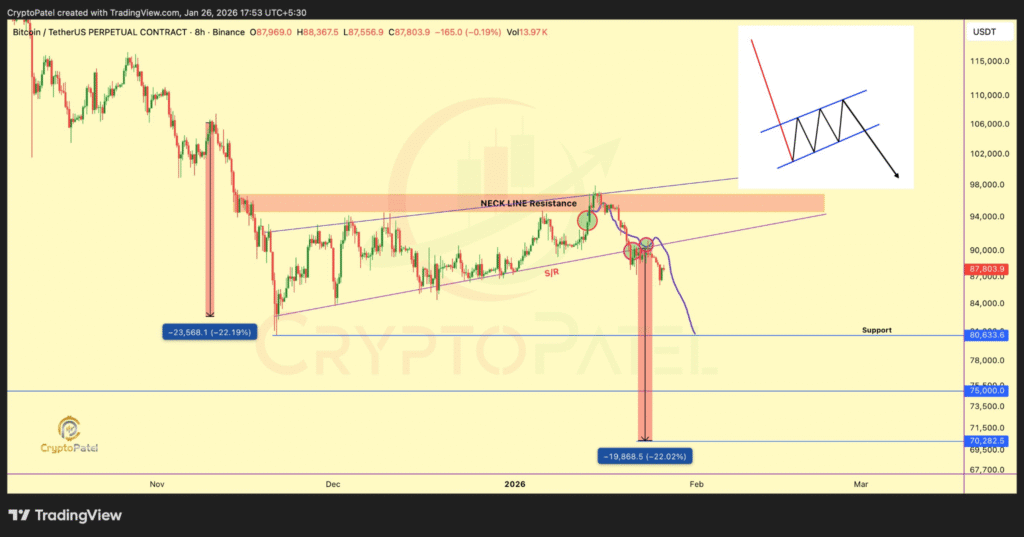

Bitcoin Confirms Bearish Trend After Neckline Rejection

Bitcoin ($BTC) has confirmed a bearish market structure after rejecting the 94k-98k neckline resistance level. According to a recent update by analyst Crypto Patel, this rejection marks the failure of the Head & Shoulders pattern, which led to a bear flag breakdown. With the neckline resistance now rejected, the downside momentum is likely to continue.

The outlook remains bearish as long as Bitcoin stays below $90k. If the price fails to break above this level, further downside movement is expected. The key support levels to watch are $80k, $75k, and $70k, which could act as potential reversal points.

Potential for Further Decline and the Path Ahead

The current market structure points to a possible continuation of the bearish trend. According to Patel, a measured move from the current price levels suggests Bitcoin could fall toward the $75k to $70k range, representing a 22% downside from its current levels. Traders should remain cautious, as the trend suggests a continuation of the downtrend if resistance levels are not breached.

While the trend is decisively bearish for now, a shift in momentum could occur if Bitcoin manages to reclaim levels above $92k. This would signal a potential reversal to bullish territory. However, until that happens, the advice is clear: respect the trend and consider selling rallies.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.