- Nvidia’s bullish breakout may signal a strategic shift toward digital assets.

- MicroStrategy’s Bitcoin model outperformed tech giants and traditional investments.

Nvidia closed strong on May 2, 2025, ending the session at $111.61 with a 2.47% gain. The stock traded within a range of $111.30 to $114.94, breaking above a descending trendline that had held since February. Analysts viewed the breakout as a key technical shift, backed by a high trading volume of 236.12 million shares.

The move placed Nvidia near a resistance level at $114.82, a zone where previous rallies had stalled. This area now serves as a critical point of interest for traders assessing further upside. The recent rally follows a reversal in April, marked by a series of green candles and strengthening momentum.

Earlier in the year, Nvidia fell from above $145 and faced multiple failed recovery attempts. Now, technical indicators suggest renewed bullish pressure. A sustained move above $115 could confirm the trend and set the stage for a possible run toward the next resistance near $136.10.

MicroStrategy Shifts the Corporate Treasury Playbook

MicroStrategy, now known as Strategy, is redefining corporate reserve management. In Q1 2025, the company reported revenue of $111.1 million, down 3.6% from the previous year.

Despite the decline, Strategy gained $5.8 billion from Bitcoin holdings, achieving a 13.7% yield year-to-date. This move reinforces its position as a crypto-focused balance sheet leader.

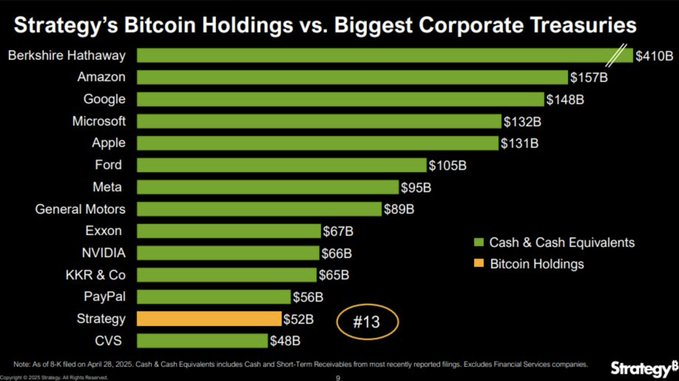

Analyst Fred Krueger said Strategy’s balance sheet could outperform Apple’s within 18 months. The firm now holds $52 billion in Bitcoin, ranking #13 among corporate treasuries, between PayPal and CVS.

Krueger noted that Strategy’s asset model rivals the cash reserves of top firms. Apple holds $131 billion in cash and short-term assets, but Strategy’s Bitcoin-heavy stance signals a shift in value storage.

He also described buying MicroStrategy stock as “a very fiat move.” In his view, true Bitcoin supporters prefer direct ownership over exposure through corporate equity.

Bitcoin Outpaces Traditional Assets Under MicroStrategy’s Model

However, on August 10, 2020, under Executive Chairman Michael Saylor, MicroStrategy adopted Bitcoin as its primary reserve asset. Since then, the firm’s stock has surged 3,142%, marking the start of its so-called Bitcoin Standard Era (BSE).

Strategy claims to lead all significant assets in BSE returns, outperforming Nvidia, which posted a 916% gain over the same period. Bitcoin rose 715%, while Tesla gained 205%, Meta 121%, and Google 118%.

Comparatively, traditional investment vehicles lagged. The SPY ETF returned 68%, while GLD, which tracks gold, rose 56%. Bonds under the BND ETF fell 18%, highlighting Bitcoin’s comparative strength. Strategy’s returns show how a Bitcoin-centric treasury strategy can dramatically impact stock performance and investor value.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.