- CryptoQuant’s heat map shows Bitcoin entering historical overheating territory.

- MicroStrategy’s latest signal hints at central BTC accumulation ahead.

Bitcoin is showing signs of intensifying market activity, as fresh data highlights rising demand pressure. CryptoQuant’s latest analytics tools include a Spot Volume Bubble Map identifying Bitcoin’s behavioral heat zones.

The visual model classifies market conditions into four zones: neutral, cooling, heating, and overheating. These categories track long-term price behavior and historical peaks, including the 2021 top at $69,000.

According to CryptoQuant, early 2025 shows a return of overheating signals, with Bitcoin hovering around $94,000. Analysts report that in late 2024, a heating trend began after a neutral stretch. This momentum progressed into red and dark red clusters, indicating more vigorous buyer intensity.

In previous cycles, cooling zones dominated during market corrections in 2018 and 2022. Heating signals were evident in 2020 and mid-2023, ahead of major bull runs. The new tool offers structured insight into cyclical pressure, supporting data-based decision-making for traders.

MicroStrategy Sparks Speculation of More BTC Buys

MicroStrategy may be preparing to expand its Bitcoin position again. CEO Michael Saylor posted a strategic update on X, featuring a snapshot of the company’s live BTC portfolio. In past cycles, similar updates preceded official acquisition announcements.

The firm holds 553,555 BTC, currently valued at approximately $52.87 billion. Saylor’s comment, “Too much blue, not enough orange,” has drawn attention from market observers. Many interpret this as a signal that more BTC accumulation could be imminent.

The company recently announced plans to raise $84 billion through stock offerings to buy more Bitcoin. If completed, MicroStrategy’s holdings could rise to 600,000 BTC, over 2% of the total circulating supply.

Analysts believe this could increase pressure on market supply and influence near-term price direction.

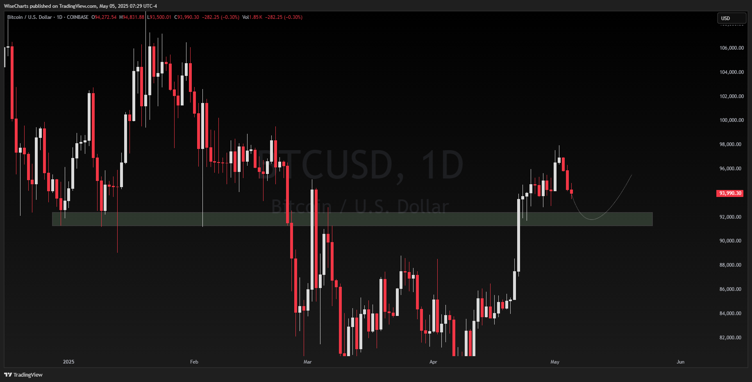

Bitcoin Price Pulls Back Toward Key Support

Bitcoin has entered a correction phase after peaking close to $96,000. The asset is testing support between $92,000 and $93,000, a previous resistance level during April’s breakout. Crypto analysts note that the correction remains orderly, with no panic signals in early May.

The price has dropped by over 2% since the start of the month. Market participants are watching for a successful hold above $92,000, which could renew bullish momentum. A bounce from this level may trigger a move toward the $100,000 mark.

Failure to hold this support could lead to a deeper pullback, challenging the structure built last month. Analysts stress that the subsequent few sessions are critical for determining near-term direction. At press time Bitcoin is now priced at $94,264.60, down 0.92% in the past 24 hours.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.