- Berachain leads new entrants with $3.5B TVL, surpassing Avalanche’s position.

- Hemi joins the list without FDV but matches Polygon in liquidity.

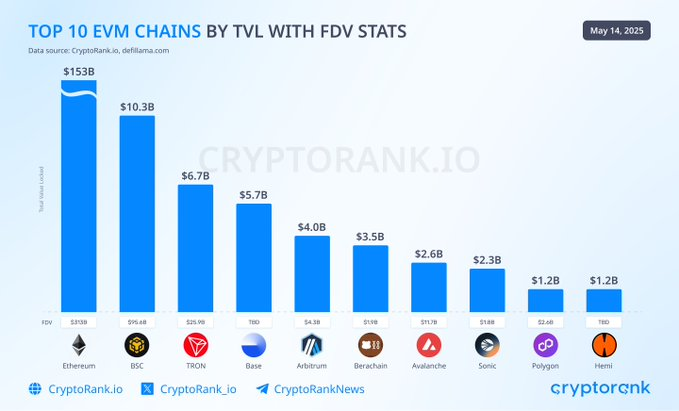

The landscape of Ethereum Virtual Machine (EVM) compatible chains continues to evolve. According to CryptoRank, three new entrants have joined the top 10 chains by total value locked (TVL): Berachain, Sonic, and Hemi.

While Berachain and Sonic have established market valuations, Hemi is still awaiting its fully diluted valuation (FDV). The rankings highlight the dynamic nature of the blockchain ecosystem as new projects gain traction.

Overview of Top EVM Chains by TVL

Ethereum remains the leading EVM-compatible blockchain, holding a dominant $153 billion in TVL. Binance Smart Chain (BSC) follows with $10.3 billion locked, confirming its sustained popularity. TRON ranks third with $6.7 billion in TVL. The list includes Base and Arbitrum, with $5.7 billion and $4 billion, respectively, though Base’s FDV remains undisclosed.

Berachain, Sonic, and Hemi are the latest additions shaking up this landscape. Berachain holds a TVL of $3.5 billion with an FDV of $1 billion. Sonic has $2.3 billion TVL and a market valuation of $1.1 billion. Hemi matches Sonic’s TVL at $1.2 billion but has yet to announce its FDV. The presence of these chains in the top 10 reflects growing user interest and investment.

New Entrants: Berachain, Sonic, and Hemi

Berachain enters the top 10 with a $3.5 billion total value locked. Its FDV is currently at $1 billion, positioning it as a strong competitor in the mid-tier blockchain segment. According to CryptoRank data, Berachain’s rise illustrates increasing adoption and liquidity. It now sits ahead of Avalanche, which has a TVL of $2.6 billion and an FDV of $1.1 billion.

Sonic holds $2.3 billion in TVL with a market valuation close to $1.1 billion. Its inclusion demonstrates rapid growth within the decentralized finance (DeFi) space. Sonic’s market capitalization suggests confidence from investors, contributing to its standing among established chains.

Hemi matches Sonic in TVL with $1.2 billion but is still awaiting its fully diluted valuation. This absence of FDV data indicates Hemi’s relatively new position or pending market evaluation. Despite this, the chain’s TVL has already attracted significant liquidity. Its arrival on the list marks an important milestone.

These three chains now share top-10 space with Polygon, which holds $1.2 billion in TVL and an FDV of $2.6 billion. Polygon remains a key player, though its market value exceeds that of some newer entrants.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.