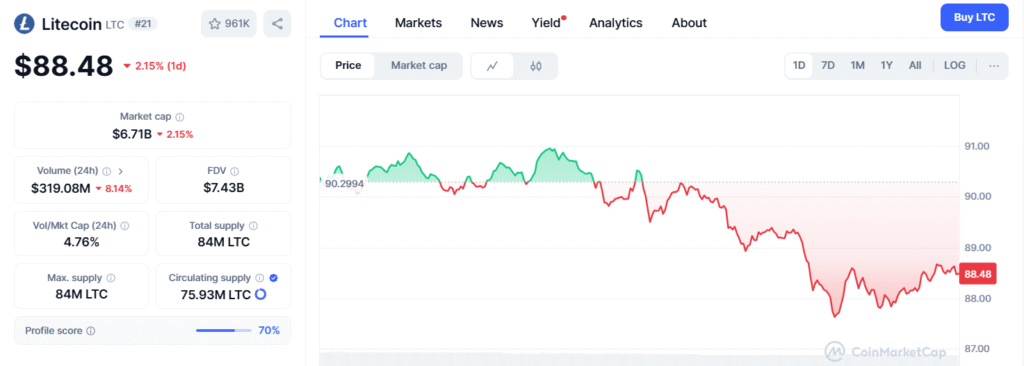

Litecoin (LTC) is back in the spotlight as it tests a key support level at $84.50, capturing the attention of crypto traders navigating a volatile market. Popular analyst CryptoTony__ recently shared a chart on X highlighting this level as a crucial turning point for LTC’s short-term trajectory.

The chart, based on a 1-hour timeframe, shows the price testing the support multiple times, indicating strong buying interest—but also raising questions about how long it can hold.

This test of $84.50 comes after LTC fell from a higher support zone around $87.50, as reported by CoinDesk on June 2, 2025. The dip suggests short-term consolidation, or possibly the early stages of a downtrend. While some traders remain bullish above the $84.50 level, others are sounding alarms. In a reply to CryptoTony__, fellow trader Alva warned that if $84.50 gives way, a move down to $82 or even $81 is on the table—a sentiment also backed by Yahoo Finance’s recent technical outlook.

Mixed Signals: Smart Money and Market Indicators

There’s growing evidence that institutional and whale wallets are quietly making moves. According to Alva, on-chain data shows both profit-taking and reactivation of long-dormant wallets, hinting at underlying volatility. These kinds of wallet behaviors often precede significant price shifts—up or down—depending on the broader market’s direction.

Traders are also watching the MACD indicator, looking for a bullish crossover to confirm momentum reversal. However, as Bitsgap warned in an April 2025 blog, MACD signals in crypto markets can be unreliable during periods of whipsaw volatility, especially on lower timeframes.

Beyond the Charts: Litecoin’s Fundamentals Look Strong

While short-term technicals are murky, Litecoin’s fundamentals have quietly grown stronger. The recent unveiling of LitVM at the 2025 Litecoin Summit on May 31 has sparked renewed interest in the coin’s long-term prospects. As reported by CryptoTimes, LitVM is the first zero-knowledge rollup (ZK-rollup) implemented on a UTXO-based chain, unlocking trustless smart contracts and DeFi capabilities for the Litecoin network.

This breakthrough has positioned Litecoin as more than just a “faster Bitcoin.” With cross-chain compatibility with Bitcoin, Dogecoin, and Ethereum (via Polygon’s AggLayer), LitVM opens the door for multi-chain DeFi, Layer-2 scalability, and institutional-grade liquidity. Some in the community are even floating ETF speculation, citing Litecoin’s increased utility and its long-established regulatory clarity.

✅ Key Takeaways

- Support Level to Watch: $84.50 — bounce or breakdown zone.

- Bearish Target if Broken: $82–$81 range.

- Bullish Breakout Potential: $91–$94 if support holds and momentum builds.

- Catalyst to Watch: LitVM adoption and ETF narrative in Q3 2025.

What’s Next for $LTC?

In the immediate term, all eyes are on the $84.50 level. If bulls can defend it, we could see a bounce back toward $91–$94, in line with Alva’s mid-range bullish scenario. But if support fails and bearish momentum takes over, a dip to $82 or lower could be next, especially if on-chain data continues to show smart profit exits.

For traders and investors, the next few days will be critical. Monitor volume spikes, MACD trends, and wallet activity closely. With strong fundamentals in the background, this could be an ideal accumulation zone—but only if the technical floor holds.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.