Stellar Lumens (XLM) continues to intrigue investors with its price dynamics, as highlighted in a recent X post by @Morecryptoonl.

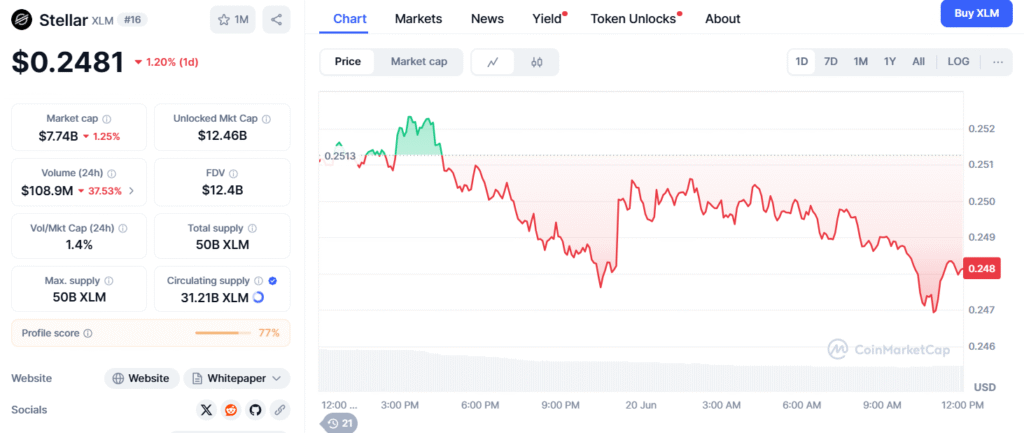

The analysis leverages Elliott Wave Theory, suggesting a diagonal pattern from the 2022 low, indicating a corrective rather than impulsive upward structure. Currently trading around $0.254 (per Independent Reserve data), XLM faces critical support levels at $0.17 and $0.219, with potential for a wave 5 rally if it holds above $0.17.

The post’s cautious stance contrasts with the crypto market’s typical bullish fervor. Historical data supports this view: XLM plummeted to $0.002 in 2014 before surging to $0.93 in 2018 (Investopedia, TradingView). The proposed diagonal pattern suggests limited momentum unless a breakout above $0.365 occurs, aligning with Fibonacci projections. However, a study from the Journal of Behavioral Finance (2019) warns that 60% of technical analysis predictions falter due to cognitive biases, urging investors to approach such forecasts skeptically.

Market sentiment remains mixed. Short-term, the $0.17-$0.219 range will be a battleground for buyers and sellers. A breach below could invalidate the bullish scenario, while a sustained move above $0.365 might target $0.70-$0.84, as noted in FXEmpire’s recent Elliott Wave analysis. Long-term forecasts diverge, with PrimeXBT suggesting $1+ by 2030 contingent on institutional adoption and remittance growth, though Benzinga predicts a more modest $0.316 average by 2025.

For now, XLM’s trajectory hinges on volume confirmation and broader market trends, especially with Bitcoin’s influence looming. Investors should monitor these support levels closely, balancing technical insights with fundamental developments. As the crypto landscape evolves, Stellar’s ability to leverage its cross-border payment niche will be key to validating this wave 5 potential.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.