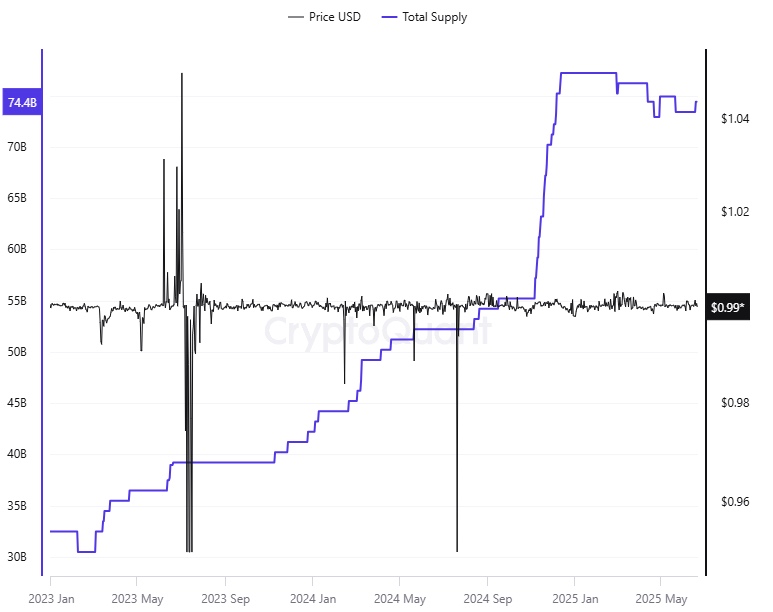

Tether USDT is currently controlling over 78% of all stablecoin liquidity, with more than $12 billion in freshly minted coins Year-to-Date.

Crypto liquidity is dependent on stablecoins as they bridge both fiat currencies and (Decentralized Finance) DeFi ecosystems. Tether, the company behind the USDT stablecoin, is signaling an aggressive desire to dominate the stablecoin market. On-chain data shows heightened demand for USDT fueled by several market fundamentals.

According to recent on-chain data by analyst Crypto Patel, Tether has minted over $12 billion USDT stablecoins in 2025. Additionally, the freshly minted stablecoins are not held idle but are circulating in the market, quenching the rising demand.

A look into the exchange netflow reveals that the newly minted USDT in exchanges has been fueling trading activity. USDC exchange netflow is negative, showing that coins have been leaving the exchanges faster than they enter. Despite a notable exchange reserve, is USDC shrinking and losing its market share?

According to the analyst, USDT has been powering both BTC and ETH rallies, leaving other altcoins starving for liquidity. While USDC leaves the exchanges, other altcoins may face challenges with pumping, especially smaller tokens in the DeFi projects ecosystem.

Why does this matter?

As one stablecoin issuer becomes dominant, its outsized influence over market flows could induce systematic risks. More Tether supply is good for increasing market activity, but also increases the market reliance on one stablecoin. Altcoins are signaling strain for stablecoin liquidity, while USDT powers the major coins.

Rising Tether dominance means rising risks for the market as this pairs the market with USDT’s behaviour and fundamentals. While the stablecoin war continues, diversity remains a safety net for the market’s long-term growth and maturity.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.