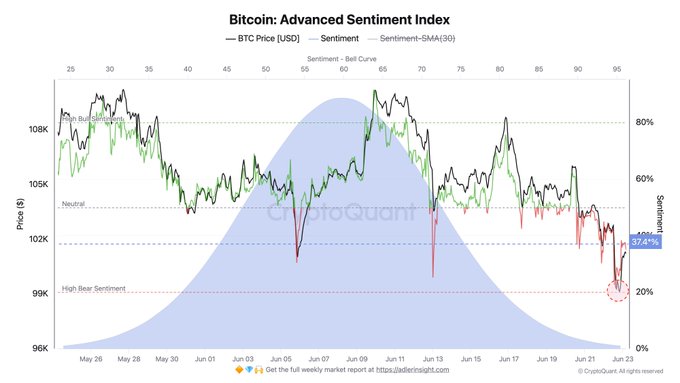

Bitcoin sentiment index has dipped to a monthly low of 20% as bears control the market. Despite short-term recovery, investors are exercising caution.

Bitcoin’s advanced sentiment index shows the prevailing collective attitude of the market in a given time. Historically, sentiment tends to precede price action, allowing traders to spot BTC tops, fakeouts, and bottoms amid price fluctuations.

As of today, the advanced sentiment index has dropped sharply as BTC broke down below the psychological $100,000 key support level. A look at the on-chain data reveals that the taker volume delta has gone negative, suggesting that bears have taken control of the market. A decrease in Bitcoin’s open interest has triggered major liquidations and heightened panic among traders.

BTC is trading at $101,891, with a 35.4% increase in trading over the past 24 hours, at press time, per CoinMarketCap. The King of crypto signals a price recovery after reclaiming the $100,000 mark and shaking off some “weaker hands” during price volatility.

According to on-chain data, the market is recovering amid the ongoing geopolitical tensions. Crypto analyst Axel Adler Jr has taken to X(formerly Twitter) to comment on the data, saying;

Sentiment according to the Advanced Sentiment index rose from 20 to 37%, and the volume delta softened while remaining in the bearish sentiment zone. This indicates partial buying of oversold positions and players’ desire to catch the pullback, nevertheless caution remains in the market due to possible escalation of the Middle East conflict.

Following BTC’s rebound, the market is still facing subtantial bearish pressure. As the bulls attempt to push up, Bitcoin needs to reclaim the $103k-$105k, a previous local support zone to confirm the momentum strength.Traders are monitoring the current fragile market amid geoplotical tensions to access Bitcoin’s next moves.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.