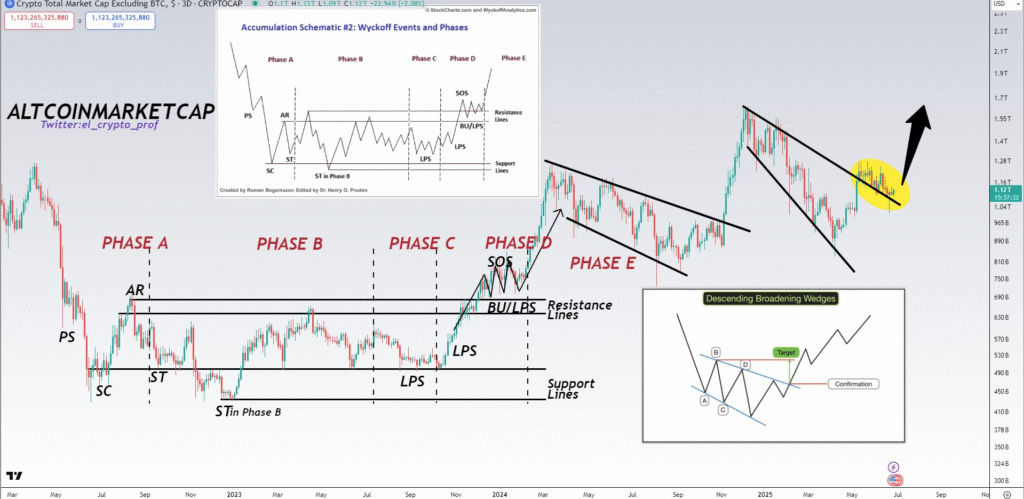

- The exclusion of altcoin market cap is tracking resistance at the level of $1.1 trillion in the crescendo of the second broadening wedge descent.

- Increased trading activity recently has indicated increased market involvement and preconditioned a possible exit over the upper trendline.

- Momentum levels such as an upbeat RSI and a swing of higher lows agree with the previous history of bullish action in accordance with a wedge formation.

The altcoin market may be on the verge of a significant move as current chart patterns show a second descending broadening wedge nearing completion. That is after a confirmed breakout of this pattern, and before that, it had made a good rally. Among analysts watching the overall altcoin market capitalization, but without Bitcoin, the advancement of its price to the high level of 1.1 trillion dollars has been described as a potential breaking point.

Historical price action shows the market moving through the Wyckoff Accumulation phases, with strong support levels established throughout 2023 and early 2024. The pattern suggests accumulation has occurred over a long period, and recent price behavior indicates growing pressure toward the upper resistance trendline.

Volume Activity and Technical Indicators Support Upside Potential

Recent trading volume spikes have added weight to the bullish outlook. These surges often signal increased market participation and a build-up before a breakout. If price action confirms above the current resistance zone, market analysts expect a swift move toward higher capitalization levels.

Just like momentum indicators are positive, the Relative Strength Index (RSI) is trending up, and the price is forming higher lows. The technical indicators, along with the broadening wedge formation, have traditionally preluded gains in market value.

As the structure of the market tightens, altcoins express signs of readiness.

The general outlook in the market is quiet and alert. Numerous investors are still tracking the wedge pattern near its peak point. Indicators of renewed interest are also visible in the altcoin, DeFi, and NFT sectors, which can add credence to an imminent move.

With the current chart configuration and technical indicators aligned, market participants await confirmation of the breakout. A decisive close above resistance may shift sentiment and open the path toward new yearly highs.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.