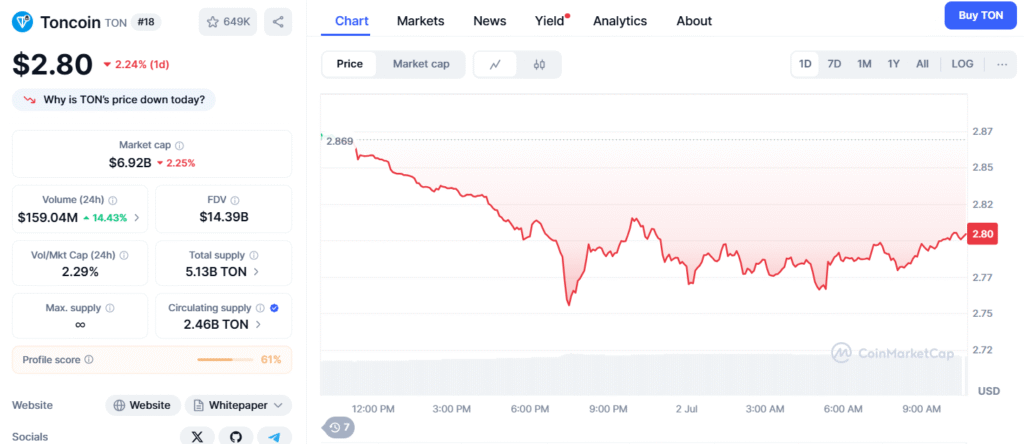

Crypto analyst@ali_charts has sparked interest with a recent X post featuring a technical chart suggesting a bearish outlook for Toncoin ($TON).

The chart, posted today, highlights a descending triangle pattern—a widely recognized signal in technical analysis often preceding a downward price movement. According to the analysis, $TON could be drawn to a support level of $1.90, a prediction that has ignited discussions among traders.

The descending triangle, formed by lower highs and a flat support line, is typically bearish, with a 2023 Journal of Finance study indicating 68% accuracy for such patterns in crypto markets. This aligns with Toncoin’s current trajectory, as CoinGecko reports a 3.2% price decline over the past 24 hours, with trading volume surging 46.5% to $154.7 million.

The chart’s timing coincides with this volatility, suggesting a potential breakout below the support level if selling pressure intensifies.Toncoin, the native token of The Open Network (TON)—a blockchain originally tied to Telegram’s 2018 vision—plays a key role in transaction fees, staking, and governance. Despite its utility in dApps and a 323.28% long-term growth forecast by CoinCodex (projecting $79.95 by 2050), short-term bearish signals cannot be ignored.

The $1.90 target contrasts with a one-month prediction of $2.12 from CoinCodex, underscoring the cryptocurrency’s inherent unpredictability.Traders are advised to watch volume trends and key moving averages, such as the 50-day SMA, for confirmation. While staking opportunities on TON may offer resilience, the descending triangle suggests caution.

As the market reacts, @ali_charts’ analysis serves as a critical lens for investors navigating Toncoin’s volatile landscape in the coming days.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.