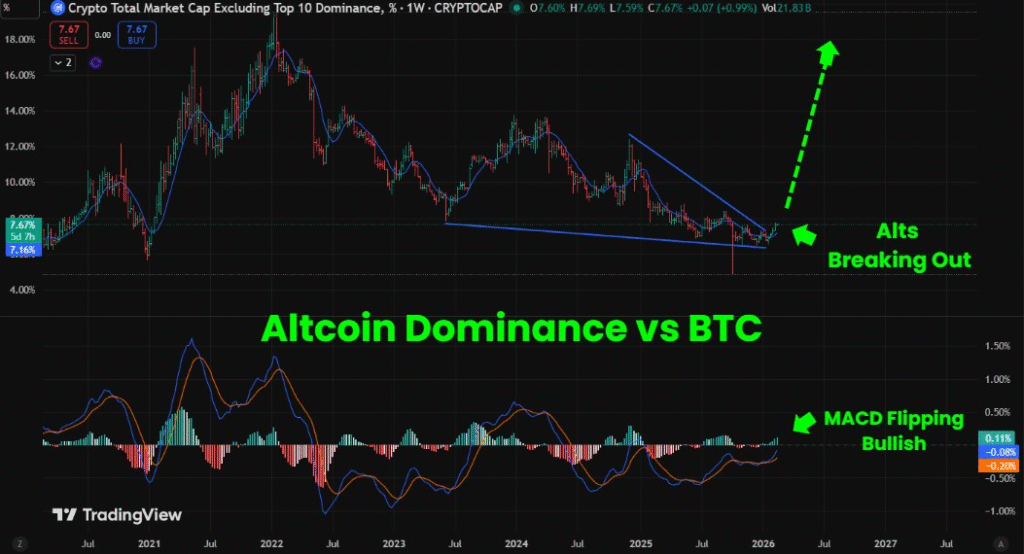

- Altcoin dominance breaks key resistance, suggesting a bullish shift in the market.

- The MACD shift signals the potential for a large altcoin rally ahead.

- High-quality altcoins in DeFi and ISO are set to attract significant investment.

As altcoin dominance breaks out of a multi-year pattern, market analysts are predicting a shift toward altcoins with strong fundamentals. With a bullish MACD signal and growing institutional interest, this could mark the start of a significant rally, leaving speculative tokens behind in favor of high-quality assets like DeFi and ISO.

Altcoin Dominance Breaks Multi-Year Wedge Pattern

A recent breakout in altcoin dominance indicates a shift in market sentiment. According to analyst Mark Chadwick, this breakout from a multi-year falling wedge pattern is crucial.

The weekly chart shows a clear upward trend, and the MACD has flipped bullish, signaling the possibility of a large altcoin rally. Historically, such movements often precede market surges, as in 2021.

This pattern reflects a potential market shift in which altcoins could outperform Bitcoin as clearer regulatory clarity begins to emerge. Traders are closely watching this shift, anticipating that altcoins might take the lead in the next market cycle.

High-Quality Altcoins Set for Significant Growth

Analysts suggest that altcoins with strong fundamentals, particularly those in ISO, RWA, and DeFi, are primed for substantial growth. With trillions expected to flow into these high-quality projects, the market is moving away from speculative tokens and focusing on those with real utility. This shift is in line with growing regulatory clarity around these sectors, which may attract more institutional investments.

Altcoins are now seen as more attractive assets due to their potential for long-term growth, especially compared to Bitcoin, which has historically dominated the market. The current market shift could pave the way for a new phase of altcoin dominance, providing opportunities for investors to capitalize on emerging projects with strong fundamentals.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.