- Altcoins near a two-year trendline, signaling possible decline.

- Analysts predict growth for altcoins after potential short-term dip.

- Altcoins expected to recover and rise after trendline test concludes.

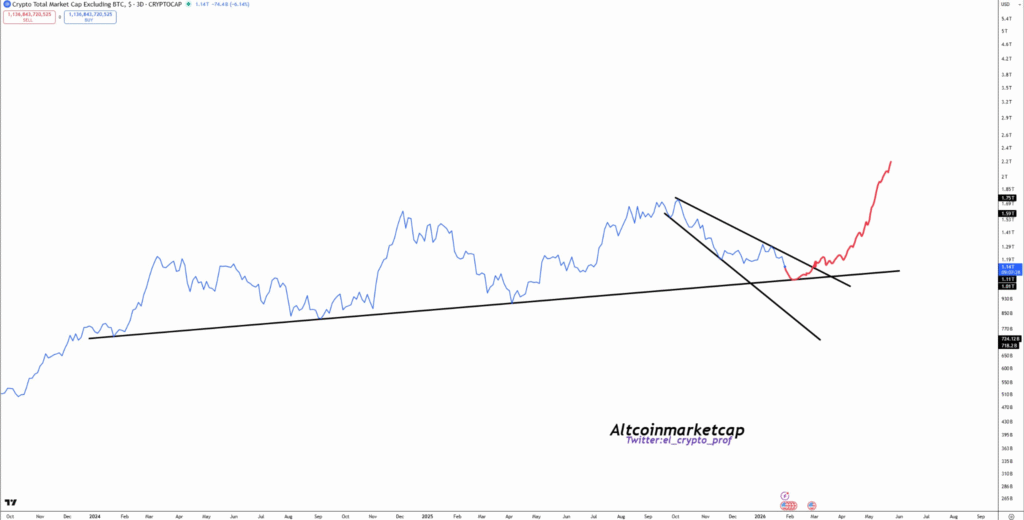

The altcoin market is at a pivotal moment, approaching a crucial two-year trendline. Experts predict a potential short-term decline before a strong recovery. Could this test be the key to unlocking the next growth phase for altcoins?

Altcoins Test Critical Two-Year Trendline for Market Direction

The altcoin market is facing a critical test as it approaches a key two-year trendline. Cryptocurrency expert el_crypto_prof recently noted that the total market capitalization of altcoins, excluding Bitcoin (TOTAL2), is approaching this important trendline.

The chart suggests that altcoins may experience a brief downturn if the trendline holds. However, this scenario is viewed as a temporary phase, as the market is expected to recover after this brief dip.

Experts believe this test is crucial for determining the short-term path for altcoins. While the trendline might signal a short-term decline, the overall outlook for altcoins remains positive. Once this test is passed, the expectation is that the altcoin market will experience a surge in value, as it has in the past after similar trendline tests.

What Happens After the Trendline Test for Altcoins?

Following the possible short-term dip, analysts predict that altcoins will likely experience growth. After the trendline test is complete, the market could shift towards a more bullish phase. The expectation is that the downward trend will be short-lived, with a recovery on the horizon for altcoins.

The upward movement is expected to follow historical patterns where altcoins gain momentum after such tests. Analysts emphasize that this trend, though volatile in the short term, suggests strong growth potential for altcoins in the future. The market is expected to continue evolving, and once it passes through this crucial phase, altcoins could experience sustained positive movement.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.