- Altcoin Momentum Builds – The TOTAL2 Macro Chart shows repeated accumulation phases, with current corrections signaling structural strength.

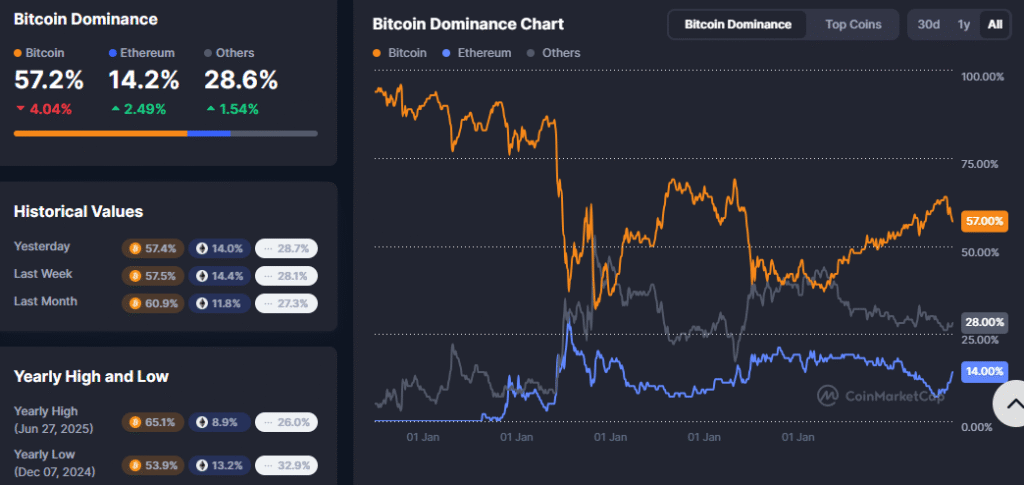

- Bitcoin’s Grip Weakens – Bitcoin dominance slipped to 57.2% from its June 2025 peak of 65.1%, reflecting redistribution toward Ethereum and other altcoins.

- Ethereum and Others Expand – Ethereum’s share climbed to 14.2%, while other altcoins rose to 28.6%, confirming growing diversification across the crypto market.

The cryptocurrency market shows a shift as altcoins strengthen while Bitcoin’s dominance retreats. Data highlights consolidation patterns that align with historical growth cycles. Current structures indicate that corrections remain part of long-term upward momentum across the wider digital asset sector.

TOTAL2 Macro Structure

The TOTAL2 Macro Chart represents the capitalization of all cryptocurrencies excluding Bitcoin. Historical cycles in 2015, 2018–2019, and 2022–2023 revealed repeating accumulation phases followed by upward rallies. These phases typically formed higher lows and double bottoms, signaling structural resilience.

Recent data highlights another base forming in the 2022–2023 cycle. Market capitalization shows signs of continuation despite corrections. These corrections are not breakdowns but rather accumulation signals that historically preceded strong advances.

The chart emphasizes long-term consistency across cycles. As each correction concludes, new phases of growth historically followed. This provides structural reassurance about the altcoin market’s ability to sustain future expansion.

Bitcoin Dominance

Bitcoin continues to lead the market but its dominance has weakened. It now holds 57.2 percent compared with a peak of 65.1 percent in June 2025. Current levels remain above the yearly low of 53.9 percent.

The downward movement suggests redistribution across the sector. Over one month, dominance declined from 60.9 percent to current levels. This indicates growing presence of alternative cryptocurrencies.

Despite short-term declines, Bitcoin still anchors the market as the primary digital asset. Its position remains central, though competition increases steadily.

Ethereum and Other Altcoins

Ethereum expanded its share to 14.2 percent from 11.8 percent last month. It recovered from a yearly low of 8.9 percent. This growth reflects strengthening adoption and market resilience.

Other altcoins represent 28.6 percent of market share. Their position has increased from 27.3 percent a month ago. They remain a significant driver of diversification within the sector.

Trends confirm an evolving market structure. Altcoins consolidate, Bitcoin adjusts, and Ethereum expands its role. Combined, these movements suggest a balanced shift in dominance.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.