- APT’s ability to hold above $5.00 will define whether momentum continues or reverses.

- A recent MACD crossover signals strengthening upside potential, with targets between $5.50 and $6.00.

- Failure to defend $5.00 could send APT back to the $4.20–$4.50 zone, extending consolidation.

APT is testing the critical $5.00 level, which has shifted from resistance into a potential support zone. The token recently rebounded after weeks of range-bound trading between lower highs and lows. Current momentum reflects renewed buying pressure, and holding above $5.00 will be decisive for short-term direction.

The recent surge suggests market participants regained confidence after repeated failures to sustain breakouts earlier in the year. The chart structure highlights $5.00 as a psychological threshold where momentum either continues upward or falters. Sustained consolidation above this level would signal improving sentiment and higher accumulation.

Failure to defend this zone could trigger renewed weakness. Price risks returning to the $4.20–$4.50 range if support breaks. Market behavior here defines whether APT enters a recovery trend or extends sideways consolidation.

Price Movement and Trend

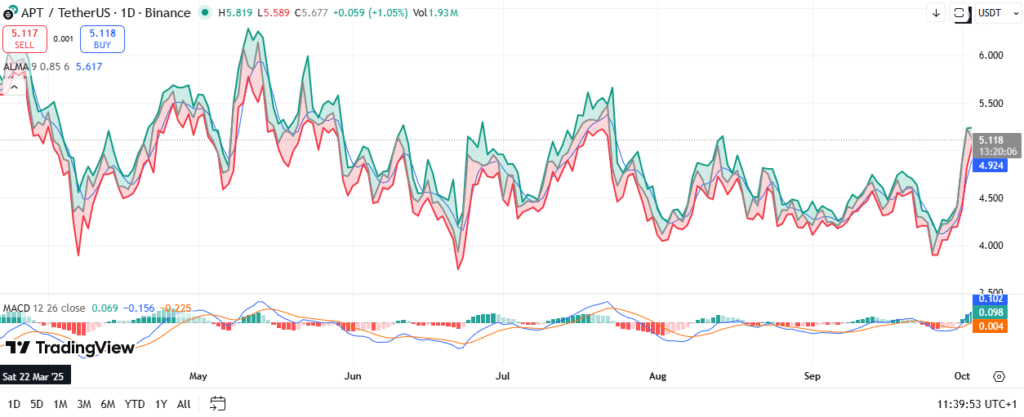

APT trades near $5.11 after bouncing strongly from the $4.00–$4.20 support region in recent sessions. The move follows several cycles of rallies and corrections, which created a volatile but recognizable trading range. This rebound currently reflects strength, as the token pushed above minor resistance points.

Source: Tradingview

The ALMA moving average stands near $5.61, keeping price slightly below this technical measure. Mixed signals, including BUY at $5.118 and SELL at $5.117, reveal market indecision. Sustained strength above $5.00 would resolve this uncertainty in favor of bulls.

If momentum persists, the next resistance lies between $5.50 and $6.00. A rejection at these levels could renew selling pressure. Mid-range support around $4.50 remains a fallback point for weaker moves.

Momentum Indicators and Outlook

The MACD indicator shows a bullish crossover, with the MACD line moving above the signal line. This development highlights improving short-term momentum on the upside. However, histogram bars remain small, suggesting trend strength is still building.

A continuation of this momentum may drive APT toward $5.50–$6.00 resistance. Failure to maintain control risks returning price closer to $4.20 support. Market conditions over the coming sessions will confirm whether this recovery develops further.

APT remains at a pivotal level, where $5.00 defines bullish continuation or renewed consolidation. The outcome determines whether this move evolves into a sustainable rally or a temporary surge.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.