- ASTER token shows signs of a potential 148.8% rally with breakout forming.

- ASTER’s circulating supply of 2.017 billion could fuel price volatility.

- ASTER trading volume spiked as token unlocks loom, adding to market uncertainty.

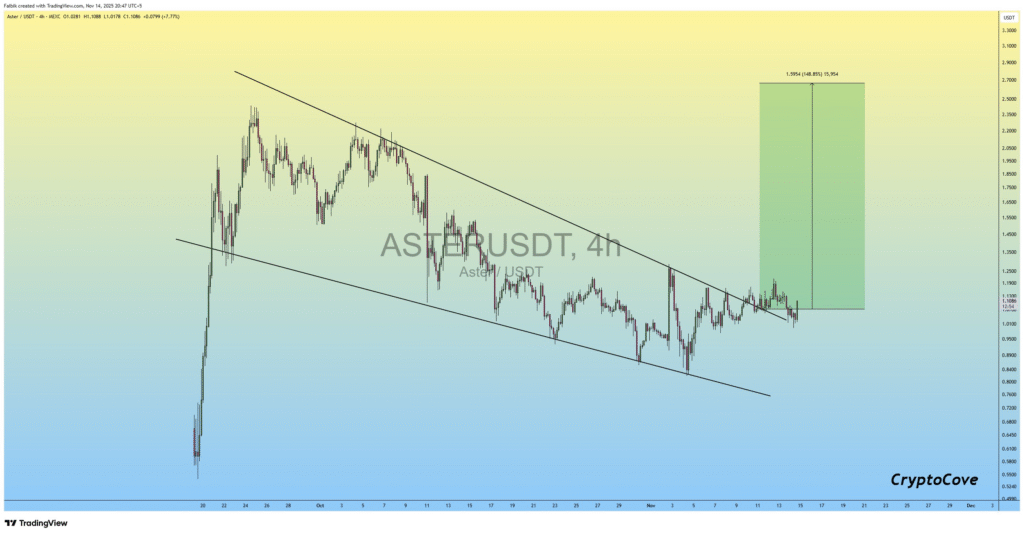

Captain Faibik, a prominent figure in the crypto community, has shared a positive outlook for ASTER, predicting a significant 150% rally in the near term. As per recent technical analysis, the 4-hour chart for ASTER/USDT reveals strong upward momentum.

The price has been moving within a clearly defined descending channel, and after a period of consolidation, a breakout is anticipated. This breakout is expected to push the price towards $1.59, marking a potential 148.8% gain from current levels.

The increasing bullish sentiment around ASTER has caught the attention of traders and analysts alike, especially as the price fluctuates between $1.02 and $1.15.

Token Unlocks and Market Concerns

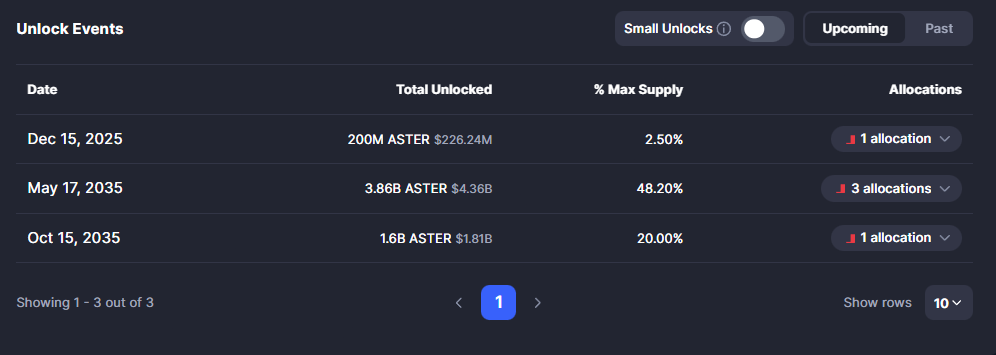

One aspect causing uncertainty in the market is the circulating supply and potential token unlocks for ASTER. At present, approximately 2.017 billion ASTER tokens are in circulation, while 6.06 billion are still locked.

This discrepancy has raised concerns among investors, as the total supply, including the locked tokens, could influence the market’s overall supply and demand dynamics.

The current market capitalization stands at around $2.28 billion, but with a fully diluted market cap exceeding $9 billion, there is potential for dilution when the remaining locked tokens are released.

ASTER’s Price Performance and Market Trends

Despite facing some market challenges, ASTER has shown resilience, trading higher on the day. As of the latest data, the price of ASTER stands at $1.14, with a notable 8% gain in just 24 hours.

Price action has remained relatively stable after an early-morning sell-off, showing that market participants remain optimistic about the token’s potential.

Traders are advised to stay vigilant and monitor the upcoming developments closely. While potential token unlocks could influence price action, ASTER’s current trajectory indicates a positive outlook for those anticipating significant growth.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.