- Binance sees high altcoin outflows, which usually reflect long-term holding by investors.

- Altcoin market cap excluding BTC and ETH rises 3% to $1.06 trillion.

- Analyst chart shows a breakout zone with targets between $1.3T and $1.4T.

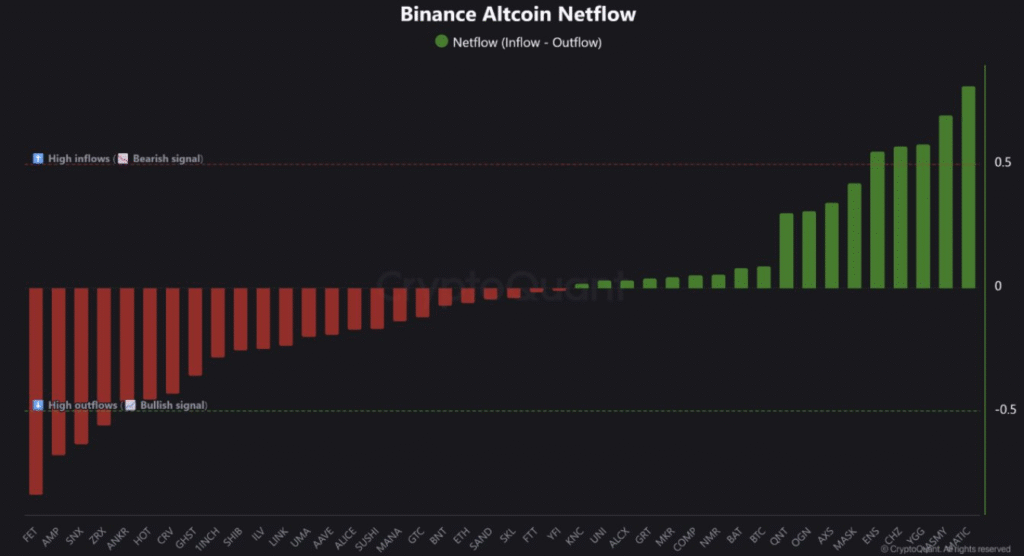

CryptoQuant analyst Burak Kesmeci reported large altcoin outflows from Binance, with five tokens showing clear movement off the exchange. This data suggests that traders are moving assets to cold storage, which is commonly seen when investors plan to hold rather than sell.

Kesmeci explained that high outflows often lead to reduced selling pressure on exchanges. “It typically shows that holders are confident,” he stated. When coins move off platforms like Binance, fewer tokens are available for trading, which may support price stability or growth.

In contrast, coins with large inflows to exchanges can show the opposite trend. Inflows often suggest that users plan to sell or trade, especially during short-term market shifts. Kesmeci noted that netflow monitoring helps assess investor sentiment based on asset movements rather than speculation.

Altcoin Market Cap Grows as Breakout Pattern Forms

Meanwhile, TradingView data analyzed by Carl Moon tracks total crypto market capitalization excluding Bitcoin and Ethereum. As of September 8, 2025, the total stands at $1.06 trillion after a 3% increase.

Moon pointed out a breakout zone on the chart that may signal trend reversal. He said the pattern could lead to a target range of $1.3 to $1.4 trillion if momentum continues. Market analysts are closely watching this setup.

Historically, such chart patterns have aligned with market phases where altcoins outperform Bitcoin, often referred to as altseason. With the current price structure and rising accumulation, that phase may be approaching.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.