- Binance’s Bitcoin netflow at -311 BTC may signal an upcoming rally in the market.

- Historically, negative Bitcoin exchange netflows have led to upward price movements.

- Binance’s netflow drop suggests traders are closely watching for a potential price surge.

In a recent update, CryptoQuant observed that Binance’s Bitcoin exchange netflow had reached -311 BTC, catching the attention of traders and analysts alike. This metric, which tracks the difference between Bitcoin deposits and withdrawals, often provides valuable insights into market trends.

What is Binance Bitcoin Netflow?

Binance’s Bitcoin netflow measures the inflow and outflow of Bitcoin on the exchange. A negative value, like the current -311 BTC, indicates that more Bitcoin is leaving the platform than entering it.

This can be interpreted as a sign that traders may be preparing for future price movements, potentially taking their holdings off exchanges in anticipation of a rise. Over time, these types of netflow signals have been seen before major upward trends in Bitcoin’s price.

Traders closely monitor these metrics, as they can indicate shifts in market sentiment. The negative netflow on Binance aligns with a pattern that has historically preceded bullish movements in Bitcoin.

CME Gap and Market Liquidity: What’s Next for Bitcoin?

Despite the potential positive outlook indicated by Binance’s netflow, other factors may influence Bitcoin’s price trajectory. The CME Bitcoin futures market recently created a gap near the $110,000 level, raising concerns among traders.

Gaps like this tend to act as “price magnets,” pulling the market towards them to fill the gap. Crypto investor Ted Pillows noted that Bitcoin has filled every CME gap in the last few months, suggesting that this gap may eventually be filled as well.

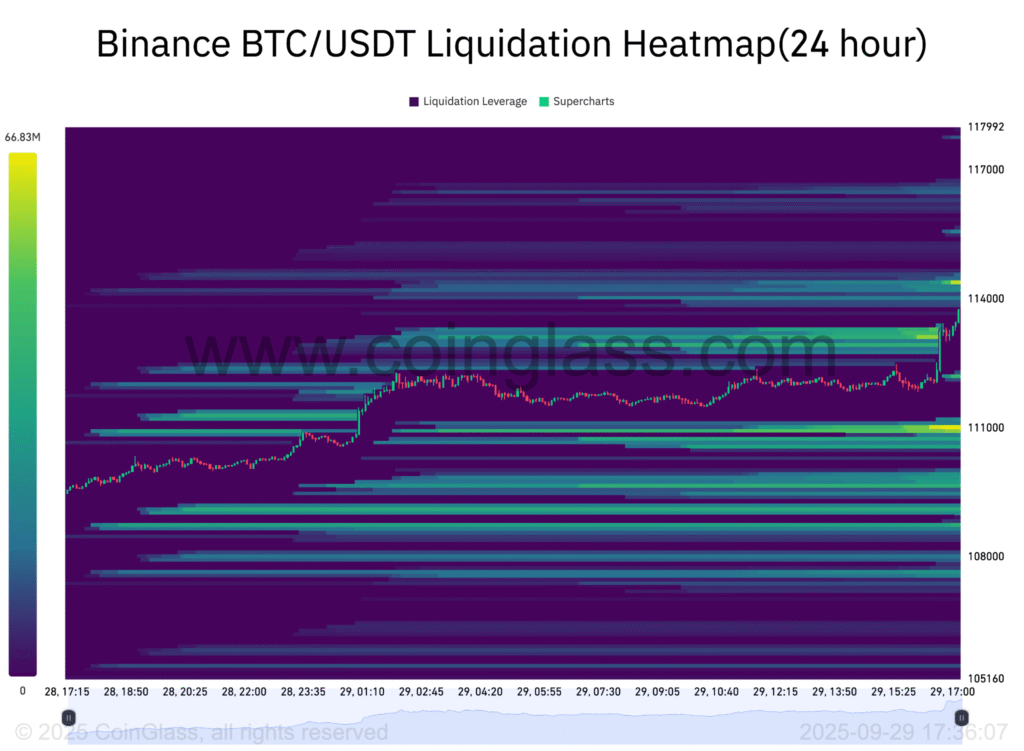

Additionally, the liquidity in the order books on exchanges continues to play a crucial role in driving market momentum. Recent data from CoinGlass revealed a mass of bid liquidity around $111,000.

As long as there is enough support at this level, Bitcoin could continue its upward trajectory. However, if liquidity dries up, the price might struggle to maintain its momentum.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.