- Binance Bitcoin Stablecoin ratio nears a rare level seen last in March 2024

- Binance stablecoin reserves hit a record $37.8B signaling rising liquidity

- Total stablecoin supply jumps to 281.2B, marking a +1648 percent increase

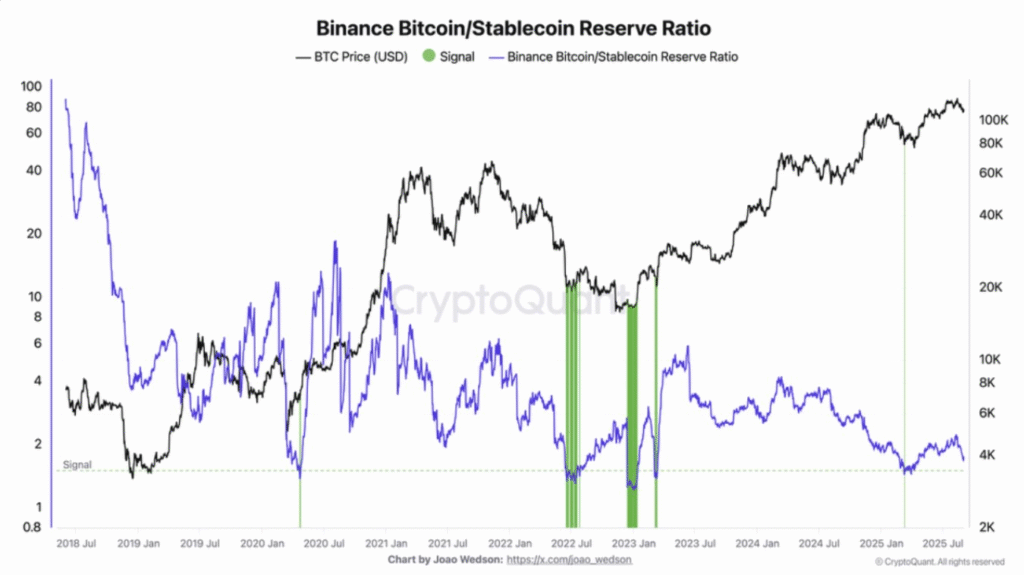

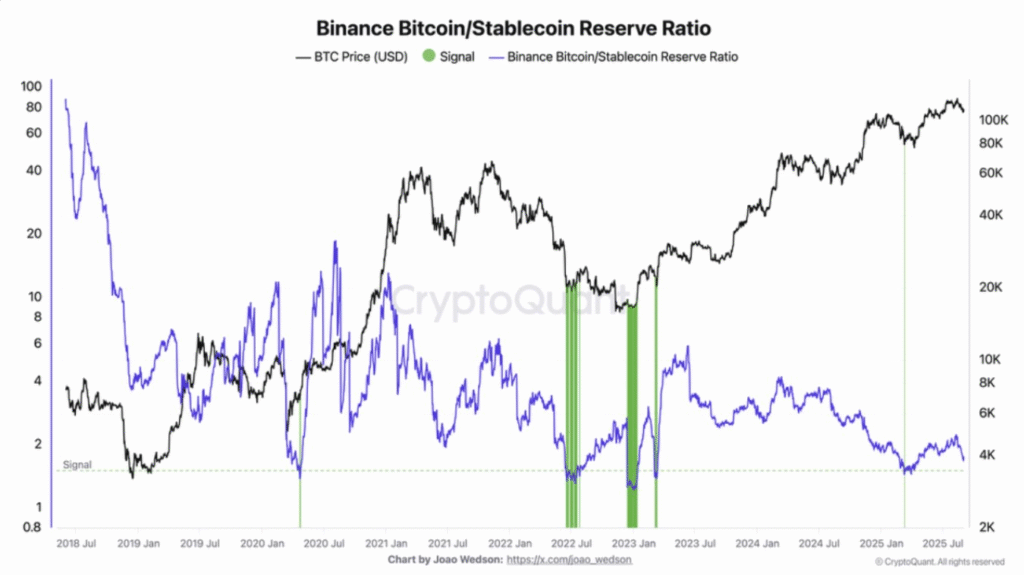

Bitcoin’s market dynamics are approaching a critical point. Analysts highlight a rare pattern forming in the Binance Bitcoin/Stablecoin ratio.

This signal has appeared only twice since the last bear market. Traders are now monitoring liquidity growth and supply expansion across stablecoins as key factors shaping Bitcoin’s next move.

Bitcoin/Stablecoin Ratio Signals Market Shift

Market analyst Darkfost_Coc data show the Binance Bitcoin/Stablecoin ratio is nearing a pivotal threshold. He notes that this signal last occurred in March 2024, shortly before Bitcoin climbed from $78,000 to a new peak of $123,000.

Chart data shows the indicator is once again approaching similar levels, suggesting possible price action aligned with earlier patterns.

Since March 2024, when the ratio last indicated a buying opportunity, Bitcoin experienced a strong rally. Traders view this measure as a gauge of market positioning between Bitcoin and stable assets. If the pattern holds, analysts suggest Bitcoin may see another sharp price surge.

At the same time, Binance’s all-stablecoin (ERC20) exchange reserve has reached $37.8 billion. This represents a record high and highlights a notable influx of liquidity on the platform.

Analysts point to the strong rise in reserves as a sign that trading capital is increasing ahead of potential market shifts. Historical trends indicate that growing stablecoin reserves often precede heightened activity in Bitcoin.

This pattern suggests that current liquidity conditions may support larger price movements in the weeks ahead.

Stablecoin Supply Growth Fuels Market Liquidity

Meanwhile, data from Artemis shows that the total supply of stablecoins now stands at 281.2 billion. This figure marks a dramatic increase of +1648% since September 2023.

Analysts underline that the supply curve has steepened, pushing issuance closer to the 300 billion mark.

Stablecoin issuance has long been viewed as a liquidity bridge for investors moving into risk assets like Bitcoin. The latest supply surge signals growing market readiness for larger capital inflows.

Analysts suggest this development could fuel the next phase of Bitcoin’s parabolic rally, reinforcing the importance of monitoring stablecoin dynamics alongside exchange ratios.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.