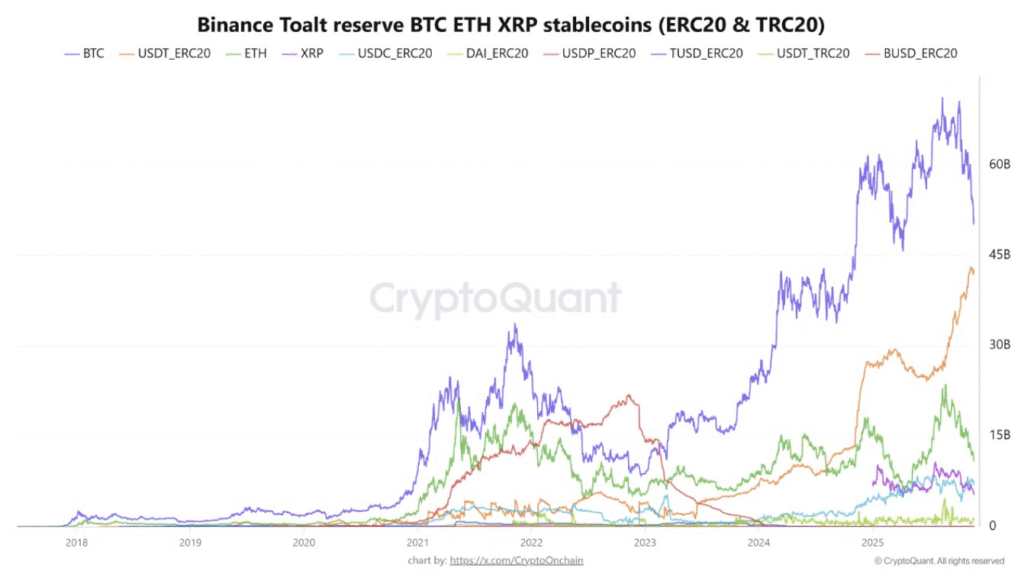

- Binance BTC reserves fell from 2022 highs while stablecoins surged past 60B in 2025.

- Traders now hold more USDT and USDC on Binance than major cryptocurrencies.

- USDT ERC20 reserves on Binance hit over $45B in 2025, rising faster than any other token.

Binance has seen a sharp reduction in major cryptocurrency holdings like Bitcoin (BTC), Ethereum (ETH), and XRP since 2022. According to data from CryptoQuant, the chart shows that BTC reserves peaked during 2022 but have steadily declined since then.

ETH followed a similar trend, though its decline was less steep. XRP reserves remained relatively stable compared to the others but still dropped from previous levels.

The data points to traders taking profits during price rallies and withdrawing their coins from the exchange. This activity often aligns with broader market cycles where traders secure gains and wait for new buying opportunities.

Stablecoin Reserves Hit Record Highs

While BTC and ETH reserves declined, stablecoins like USDT (ERC20 and TRC20), USDC, and BUSD increased significantly. The chart shows that USDT (ERC20) reserves on Binance exceeded $45 billion by late 2025. Combined stablecoin reserves on the platform crossed $60 billion, according to the visual data.

CryptoQuant noted, “This rare combination (declining coin supply + skyrocketing stablecoin reserves) suggests that traders have been taking profits at price peaks and are now sitting on the sidelines with dry powder.” This quote implies that traders may be waiting for a market dip to re-enter positions.

USDC and DAI also saw increases, though less than USDT. BUSD reserves declined after early 2023, following Binance’s announced phase-out of the token.

A Shift in Market Behavior

The increase in stablecoin reserves indicates that traders may be holding value in low-volatility assets while waiting for the next market move. The presence of more funds in stablecoins than in crypto assets points to a cautious market stance.

From 2023 through 2025, the chart shows several sharp rises in stablecoin balances, often after steep drops in BTC and ETH. This suggests coordinated profit-taking during market peaks. The behavior aligns with risk management strategies that seek to preserve capital during uncertain price action.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.