- Wallets holding 10–100k BTC added 702,137 BTC in the last 6 months.

- Bitcoin ETFs recorded $300 million net inflows by September 10.

- Retail wallets sold over 4,000 BTC, reflecting reduced short-term confidence.

On-chain data from Santiment shows a strong shift in Bitcoin ownership patterns. Wallets holding between 10,000 and 100,000 BTC accumulated 702,137 BTC over the past six months. This increase indicates renewed interest from large holders often associated with institutional or high-net-worth participants.

In contrast, smaller wallets holding between 1 and 10 BTC reduced their holdings by about 4,172 BTC. This reduction is seen as a sign of retail traders exiting positions during periods of uncertainty or low price movement.

Meanwhile, whale transaction activity remains consistently high. This suggests ongoing large-scale transfers, often related to institutional rebalancing or over-the-counter trading.

Bitcoin ETFs See $300 Million Inflows

U.S. spot Bitcoin ETFs recorded $300 million in net inflows over the four days ending September 10. This marks the strongest four-day performance for these ETFs in nearly two months. According to Bitget, global Bitcoin ETPs received $520 million during the same time.

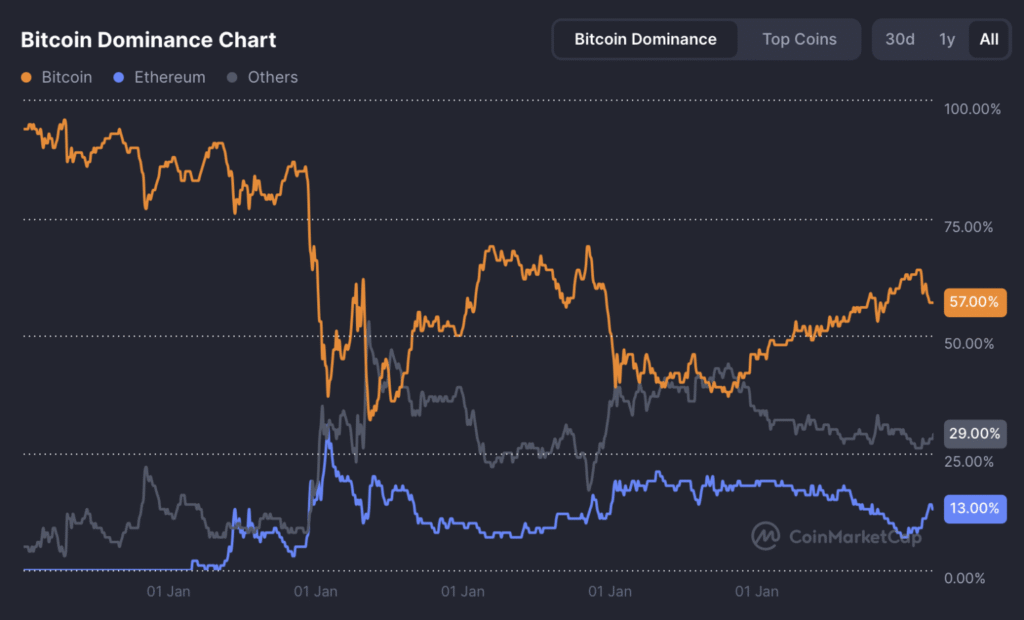

By contrast, Ethereum ETFs experienced about $700 million in outflows. This shift contributed to a rise in Bitcoin dominance, which stood at 57% as of early September. One month earlier, it was at 58.9%. The Altcoin Season Index also fell from 87 in late 2024 to 66, showing a relative move away from altcoins.

Exchange reserves continue to decline, with over 820,000 BTC withdrawn from exchanges in the past six months. This trend is typically associated with longer-term holding behavior.

Regulatory Developments Encourage Institutional Moves

On September 11, SEC Chair Paul Atkins discussed “Project Crypto” at the OECD event. He supported a unified licensing regime for crypto assets and criticized past enforcement actions as “too aggressive.” His remarks suggest the SEC may move toward clearer, tailored rules.

The GENIUS Act passed in July 2025 provided a framework for stablecoin regulation. Market analysts suggest that regulatory clarity has encouraged more institutional adoption. For instance, Galaxy Digital recently increased its XRP holdings by $34.4 million.

Anchorage Digital, custodian for BlackRock’s ETF, also reported stronger inflows in the same period. Attention now turns to the SEC-CFTC joint roundtable scheduled between September 15–20, which is expected to address DeFi and tokenization frameworks.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.