- Bitcoin must hold $116K support or risk testing $100K liquidity.

- Michael Saylor warns investors have 10 years to stack Bitcoin.

- Analysts allege BlackRock plotting control through MicroStrategy’s Bitcoin holdings.

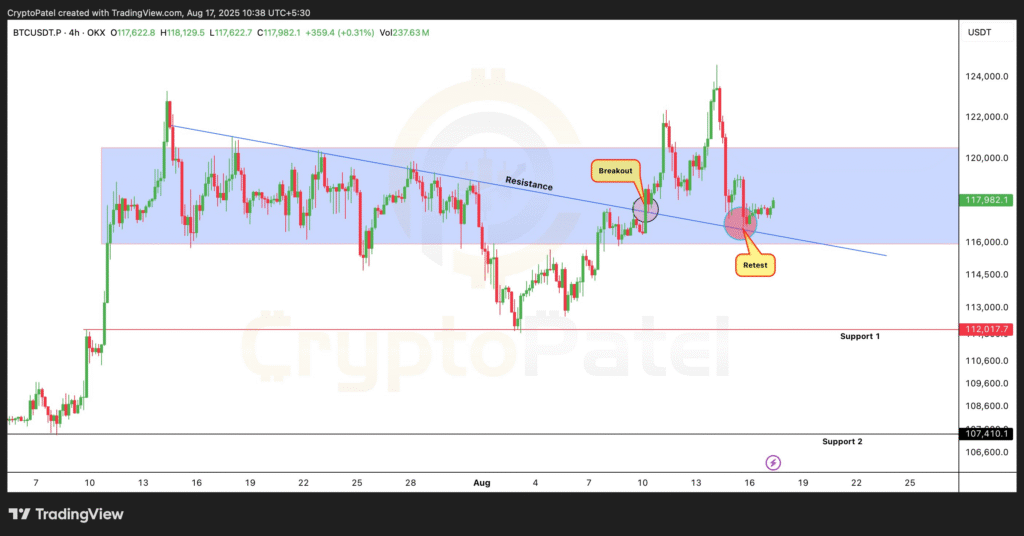

Bitcoin is trading in a decisive range with traders watching key support levels. Crypto Patel reported that Bitcoin has broken above a descending resistance and is now retesting support.

The chart highlights $116,000 as the level to hold. He said that staying above this zone could spark a bullish reaction toward a new all-time high. Failure, however, could push price action toward the $100,000 liquidity pool.

Analysts stressed that the outlook is straightforward. Either buyers maintain control by defending support, or capitulation begins if it is lost. Traders are watching closely as Bitcoin consolidates within this pivotal range.

Saylor Calls for a Decade of Accumulation

Michael Saylor issued another strong statement on Bitcoin. He said investors have “10 years to stack as much Bitcoin as you can before it’s all gone.” His comment reflects his long-standing bullish stance.

A throwback shared by CryptosRus showed Saylor predicted a year ago that Bitcoin would remake the world. Analysts noted that institutional adoption and global acceptance have moved in line with his forecast.

They added that his latest warning underscores the urgency for accumulation as supply continues to tighten and demand rises.

Regulatory Support and Market Concerns

Former SEC Chair Paul Atkins added further momentum with remarks on Bitcoin’s future in the U.S. He said the cryptocurrency will bring “huge benefits” to America.

Atkins emphasized the potential scale, saying it is so large “we can’t even calculate them yet.” Analysts responded by noting that backing from a top regulator could accelerate adoption.

Some called it a turning point for institutional acceptance and highlighted its role in strengthening Bitcoin’s position in the economy.

At the same time, Skynet Insights issued a cautionary outlook involving BlackRock’s activity. The analyst claimed BlackRock is preparing the biggest Black Swan event in Bitcoin’s history.

According to the report, the firm acquired 5% of MicroStrategy to gain control. The strategy, they argued, is designed to force Michael Saylor into selling 628,946 BTC.

Skynet Insights shared a thread outlining this scenario and warned of manipulation risks. The analyst disclosed selling all holdings today and urged traders to remain cautious.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.