- Bitcoin is again consolidating between 104k and 114k and presents a conclusive range, it is soon to move again.

- The pressure to make profits approaches the level of resistance, and the high demand remains to support the lower support levels.

- Breaking up to higher than $114K would open new highs, and a fall to less than $104K would point to long-term cooling off.

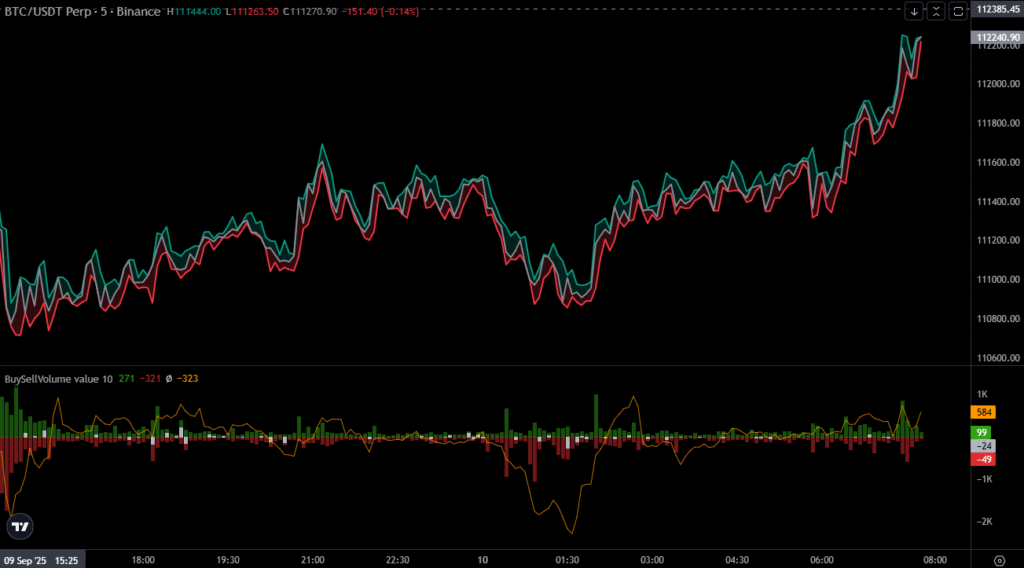

Bitcoin was trading at an almost similar level of around $111,100 and was surrounded in a narrow band of consolidation, indicating the point of choice in the next sessions. The asset was exchanged within the 104,100 to 114,100 range, showing a post-euphoria cooling zone. The data in the market demonstrates that this part of the market frequently determines the continuity of momentum or a consolidation.

Key Technical Implications

Bitcoin’s short-term structure highlights the significance of $104,000 as the lower boundary. A break below that point would confirm exhaustion and extend corrective pressure. Therefore, downside activity remains a clear risk if demand weakens further.

Resistance sits closer to $114,000, where a sustained move higher could confirm renewed demand strength. Reclaiming that zone would attract sidelined buyers and restore bullish momentum. As a result, the range between $104,000 and $114,000 defines the immediate outlook.

The cost basis quantile model outlines the importance of these levels. Prices have tracked near the upper quantiles, showing profitability among holders. Profit-taking behavior typically accelerates in this band, creating additional short-term selling pressure.

Market Structure and Behavior

Bitcoin’s alignment with the higher quantiles signals that most wallets remain in profit. This alignment strengthens selling pressure as price climbs closer to resistance. However, strong demand at lower boundaries demonstrates that buyers continue to defend support levels.

Source: CoinAnalyze

Historical data shows this type of consolidation often follows euphoric rallies. The pattern highlights either extended cooling phases or renewed growth once pressure eases. Therefore, the current zone represents a balancing point between demand and fatigue.

Traders consider this consolidation period as a signal of structural stability. Price remains trapped within quantile boundaries, limiting immediate breakout or breakdown potential. Nevertheless, activity in this band will define Bitcoin’s direction for the medium term.

Outlook

The present trading zone defines Bitcoin’s decision point. A sustained reclaim of $114,000 would confirm the strength of renewed demand and could extend price discovery. Alternatively, weakness below $104,000 would validate fatigue and force a prolonged consolidation.

Medium-term projections suggest strong demand could reappear above $114,000. This would reestablish momentum and potentially open the door toward higher highs in the coming months. Failure to clear resistance would leave price movement range-bound.

To conclude, the current status of Bitcoin can be discussed as a decisive moment. The result will determine whether markets will continue consolidating or resume their upward trend. Hence, the following actions along the lines of these boundaries will have a strong implication on the wider path of Bitcoin.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.