- Bitcoin’s pullback may give way to a bullish retest as USDT dominance falls.

- BlackRock’s Bitcoin ETF sees a $33.9B surge, surpassing all other ETFs.

- With record returns, BlackRock’s Bitcoin ETF attracts massive investor interest.

Bitcoin’s Upward Movement and USDT Dominance Decline

Bitcoin is ready for a potential retest, price action is showing an upward trend after a short term pullback. Market indicators suggest that Bitcoin could continue to rise, potentially benefiting from the decline in USDT dominance.

USDT dominance, which measures the marketcap of the stablecoin expressed as a percentage, is decreasing recently. This may represent a bearish retest of USDT, indicating that additional capital is leaving stablecoins and moving into more volatile assets, such as Bitcoin.

BlackRock’s Bitcoin ETF: Leading Market Inflows

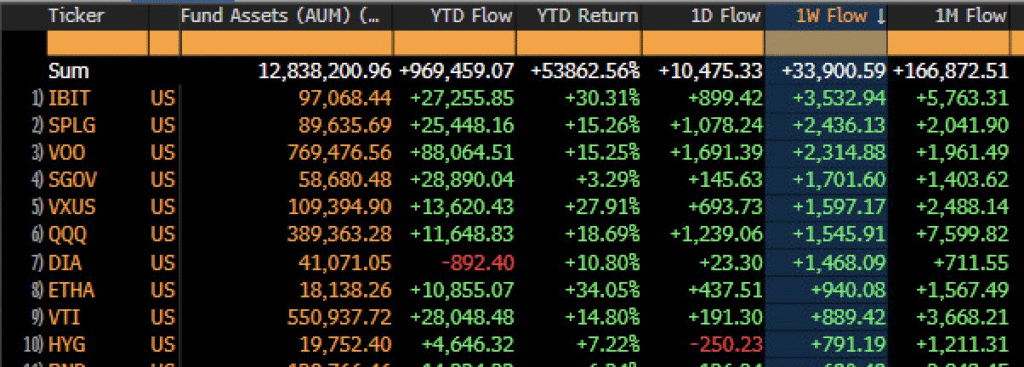

BlackRock’s Bitcoin ETF has been a standout performer in recent weeks, recording a staggering $33.9 billion in new inflows. This marks the fund as the fastest-growing ETF in history, surpassing all others in terms of weekly performance. The data reflects strong investor confidence in Bitcoin, likely fueled by its upward momentum and BlackRock’s strategic positioning.

With year-to-date inflows nearing $970 million and an eye-popping 53,862.56% return, the fund’s growth has been extraordinary. The impressive performance continues to attract more attention, further solidifying its place as a dominant player in the ETF space.

This kind of growth along with the fund’s appeal to investors means institutional money is approaching the crypto market differently. BlackRock’s Bitcoin ETF is not only getting massive inflows but also setting records in the sector.

Despite market volatility concerns the fund’s success is changing the narrative around cryptocurrency investments. As institutional players like BlackRock enter the space it means Bitcoin is becoming more legitimate and accepted as an asset class.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.