- itcoin Cash is up 3% in 24 hours, trading near $487 after ETF news.

- T. Rowe Price filed for a crypto ETF expected to hold Bitcoin Cash.

- BCH trades below $496 resistance while RSI nears oversold levels.

Bitcoin Cash (BCH) is gaining renewed interest as prices climb amid growing institutional attention. The coin traded higher after news emerged that T. Rowe Price, a traditional asset management firm, filed for a new crypto ETF. Traders are now watching closely as BCH approaches a key resistance zone.

Bitcoin Cash Gains as T. Rowe Price Files Crypto ETF

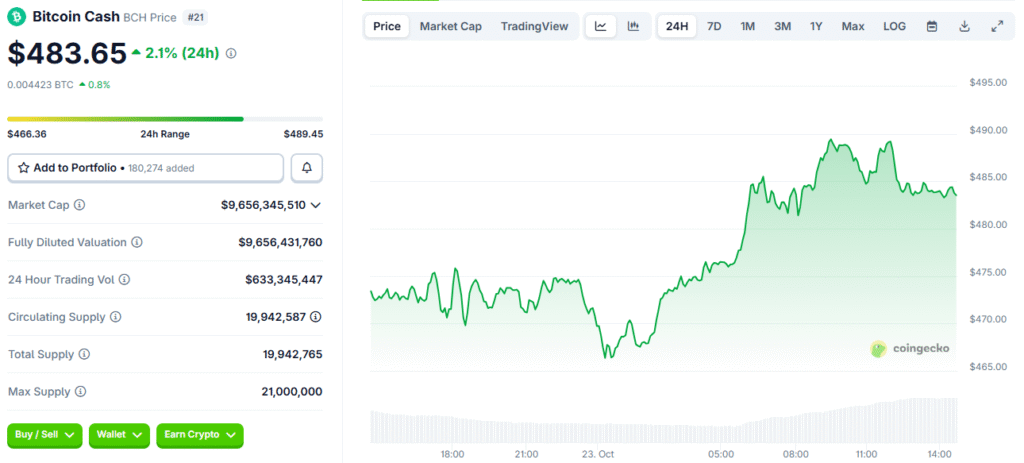

Bitcoin Cash (BCH) experienced a price increase of over 3% in the last 24 hours, reaching approximately $ 483.65. The price moved between $466.36 and $489.45, showing short-term buying interest. The rise comes as market attention shifts to traditional finance entering the digital assets market.

T. Rowe Price, a U.S.-based asset manager with $1.8 trillion in assets under management, filed an S-1 registration for a crypto ETF on October 22, 2025. Bloomberg analyst Eric Balchunas confirmed the filing. The proposed ETF would include 5 to 15 digital assets, among them Bitcoin Cash, and would aim to outperform the FTSE Crypto US Listed Index.

Nate Geraci, President of ETF Store, said: “A firm founded in 1937 is now building full crypto infrastructure,” describing it as a major development. This move signals a growing shift by legacy institutions toward crypto investments as they face challenges in traditional markets.

Resistance Nears as Traders Monitor Breakout Levels

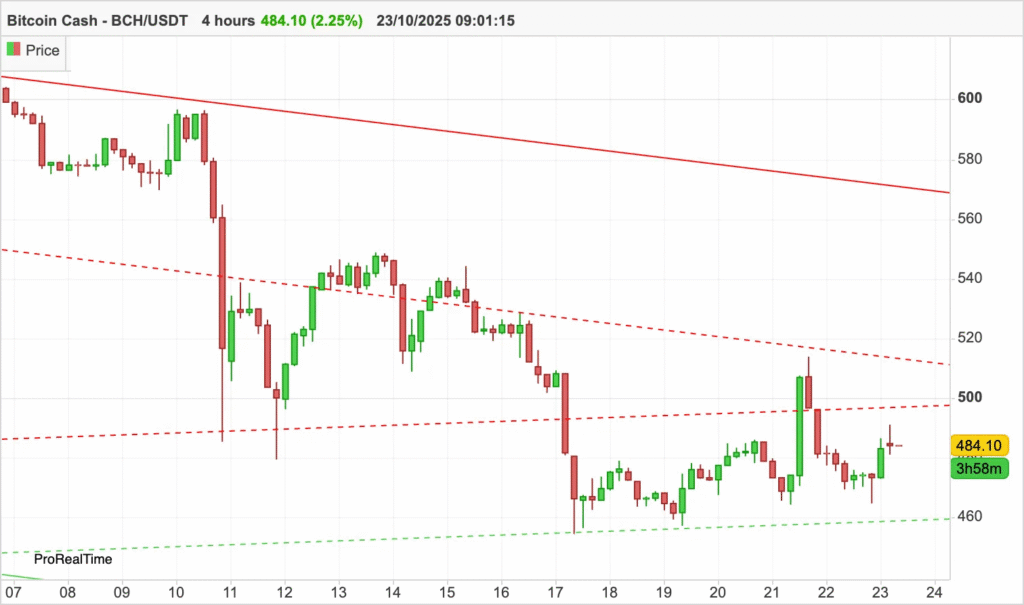

Despite recent gains, BCH remains down over 6% for the week. Traders are now closely watching the $496.8 resistance level. A successful breakout could lead the price toward the $520–$550 zone in the near term.

According to CentralCharts, BCH is still trading within a consolidation range. Technical signals on TradingView show 14 sell signals compared to only two buy signals. The RSI stands at 38.9, indicating BCH is approaching oversold territory, which could attract dip buyers if momentum improves.

Technical analyst Sjuul from AltCryptoGems noted that BCH’s upward trend had weakened in recent weeks. He said the coin showed signs of a “pretty ugly downtrend” due to repeated lower highs and failed breakouts.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.