- Bitcoin may dip below $107K before reversing its trend according to experts.

- Bitcoin’s price faces a correction with critical support at $111K in focus.

- Liquidity in the market is being reduced, triggering short-term price volatility.

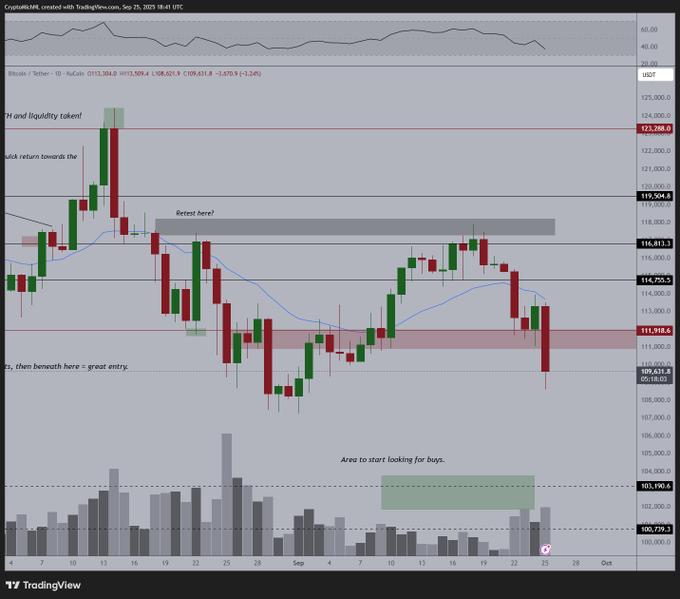

Bitcoin’s price has entered a correction phase after failing to maintain key support levels. Following a strong rally post-FOMC, the cryptocurrency has seen a decline in price.

Analysts, including Michaël van de Poppe, have highlighted that Bitcoin could dip below the $107K mark before any potential trend reversal.

Despite this short-term downturn, van de Poppe believes that 90% of the correction has already occurred. He suggests that better times may be ahead for Bitcoin traders and investors.

Market Sentiment and Liquidity Concerns

As Bitcoin’s price adjusts, liquidity is being drawn out of the market. The cryptocurrency’s sharp downward movement has reduced market momentum.

According to recent reports, long-term holders (LTHs) have been realizing substantial profits, with 3.4 million BTC being sold off.

While the market was initially energized by ETF inflows, these have slowed down in recent weeks. This slowdown in ETF activity, combined with the overall weakness in both spot and futures markets, indicates that Bitcoin’s rally may be over for now.

Support Levels and Potential for Reversal

One of the key levels being closely watched is Bitcoin’s $111K support zone. According to Glassnode’s recent data, this level could act as a critical point. If Bitcoin fails to hold the $111K support, the price could face further downside risk.

Additionally, the liquidation heatmap suggests that volatility may increase as Bitcoin approaches this crucial support level. Experts advise traders to monitor Bitcoin’s price closely as it nears these thresholds.

Overall, while the market has entered a correction phase, the overall sentiment remains bullish in the long run. Meanwhile, key support levels are being monitored for signs of a potential reversal. If Bitcoin holds these levels, it could pave the way for renewed upward momentum in the coming weeks.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.