- CryptoQuant data shows flattening accumulation, indicating longer Bitcoin cycles.

- TradingView charts reveal bullish breakouts, confirming signals of upward momentum.

- Pompliano stresses patience, citing long-term holders’ conviction amid volatility.

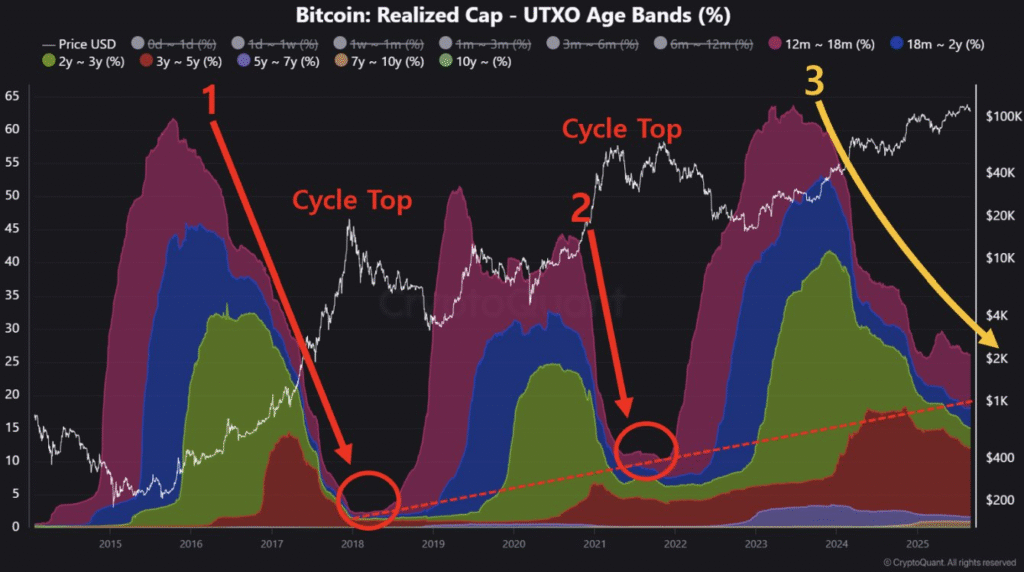

Bitcoin’s latest cycle shows signs of slowing growth, with analysts pointing to a potential delayed peak. CryptoQuant data highlights a shift in Bitcoin’s realized cap UTXO age bands. The chart measures the percentage of Bitcoin held for over a year, based on realized market cap.

Historical analysis shows that in 2017 and 2021, sharp surges in this metric preceded cycle tops. Each peak was followed by sell-offs that reset long-term holder activity.

In the current phase, analysts note a flattening slope in accumulation. This points to longer cycles and slower market dynamics.

The shift suggests Bitcoin’s growth is maturing, with extended timeframes before major peaks. A project that renewed momentum could arrive in fall 2025, aligning with the trend of lengthening cycles.

Technical Indicators Point to Bullish Breakout

Charts from TradingView highlight repeated historical breakout points since 2012. Each of these breakout signals has preceded strong upward momentum in Bitcoin’s price.

The Awesome Oscillator indicator also shows recurring crossover patterns. Analysts note that the latest crossover, confirmed in 2025, mirrors setups seen before major rallies.

According to historical trends, these technical patterns often mark the start of significant bull runs. Analysts suggest Bitcoin could soon enter another phase of upward price movement. This aligns with expectations of new highs forming if momentum continues.

Market Analysts Urge Patience Amid Declines

Anthony Pompliano, a well-known Bitcoin analyst, addressed concerns following recent price weakness. He said investors should remain calm despite volatility. Citing on-chain data, Pompliano emphasized that the network remains healthy. He pointed out that long-term holders show conviction and are not selling their coins.

According to Pompliano, this behavior reflects strength within the Bitcoin ecosystem. He advised investors to “just chill” and maintain a long-term outlook.

His comments come as at press time Bitcoin trades at $109,926.94, a 2.66% decline in the past 24 hours. Analysts suggest that while short-term moves may unsettle some, long-term signals indicate resilience in the market.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.